Will the Stock Market Crash? High Valuations Spark Investor Fears

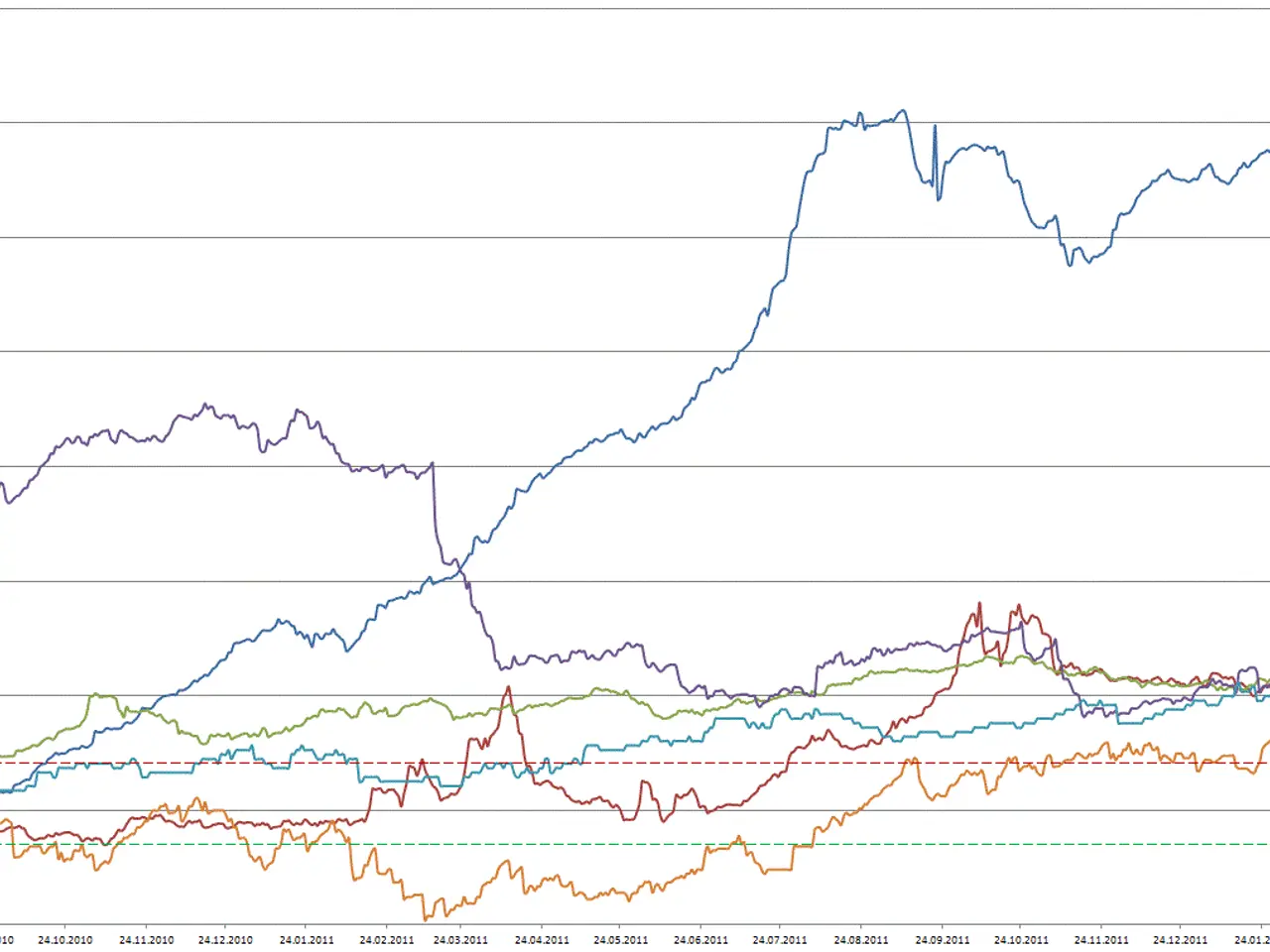

Investors are growing anxious about a potential stock market crash as the S&P 500 reaches high valuations. The Shiller P/E ratio, which adjusts for inflation over a decade, now stands near 41—a level last seen before the dot-com crash in the early 2000s. Concerns are rising over whether AI-driven hype and uncertain returns on heavy tech stocks could trigger another downturn.

The Shiller P/E ratio, also known as the CAPE ratio, currently stands at nearly 41. This matches levels from 2000, just before the dot-com bubble burst. In 2021, the ratio was around 39, and the stock market fell sharply the next year.

Experts suggest several ways to reduce risk. Diversifying across different asset classes and sectors can help spread exposure. Keeping an emergency fund of three to six months’ expenses provides a financial cushion. Regularly rebalancing a portfolio ensures it stays aligned with long-term goals. For those worried about a crash, shifting away from overvalued stocks may be wise. Investing in dividend-paying or value stocks can offer more stability. Exchange-traded funds (ETFs) with international exposure or ties to steady sectors also lower risk. Warren Buffett has long argued that short-term stock market predictions are impossible. Instead, he advocates for a long-term approach. Investors with at least five years until retirement might consider holding S&P 500 index funds through ups and downs. Alternative investments, such as real estate or commodities, can add extra protection during downturns. Defensive stocks and bonds often hold up better in volatile markets. But the right strategy ultimately depends on an individual’s risk tolerance and time horizon.

The current Shiller P/E ratio signals caution, but no single indicator guarantees a stock market crash. Investors can take steps to protect their portfolios by diversifying, maintaining liquid savings, and focusing on long-term stability. The best approach varies by personal circumstances and financial goals.