Why Olympia Capital's quiet growth mirrors East Africa's untapped potential

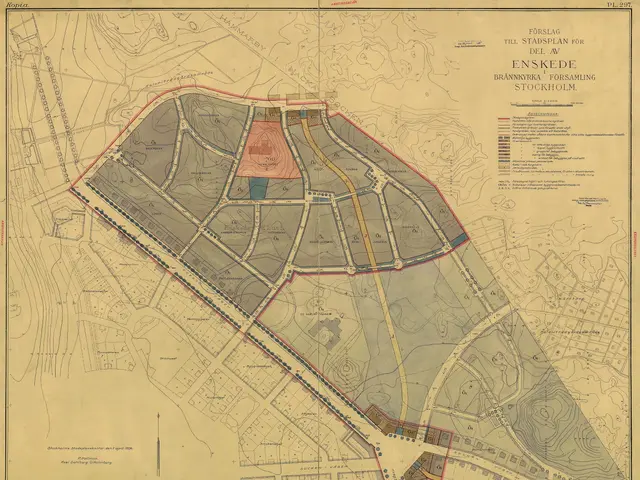

Olympia Capital, a small building materials supplier, trades on the Nairobi Securities Exchange. The company offers investors a chance to tap into East Africa's rapid urbanisation and infrastructure expansion. Yet its shares remain off the radar for many, including German investors, due to low liquidity and limited market visibility.

The firm specialises in construction materials, positioning it to benefit from Kenya's booming cities and major projects. Nairobi, as East Africa's financial centre, drives much of this growth, attracting investors with its expanding population and infrastructure needs. However, Olympia Capital's modest size and lack of analyst coverage keep it largely ignored by international markets.

Trading on the Nairobi Securities Exchange presents challenges. Wider bid-ask spreads than in major markets like the DAX make transactions costlier. Private investors also face hurdles, often needing specialised brokers to access the exchange. Despite these barriers, the company's focus on building supplies aligns with regional demand.

For those seeking African exposure, alternatives exist. Africa-focused ETFs or frontier-market funds provide broader diversification and professional risk management. These options reduce reliance on a single, volatile stock like Olympia Capital. Still, the company's direct link to East Africa's growth makes it a unique, if speculative, opportunity.

Olympia Capital remains a niche investment, blending high risk with potential rewards tied to East Africa's development. Its low liquidity and volatility demand careful consideration from investors. Those willing to navigate the challenges may find it a direct way to participate in the region's economic expansion.