Why First Trust's Long/Short ETF Is Lagging Behind the Stock Market

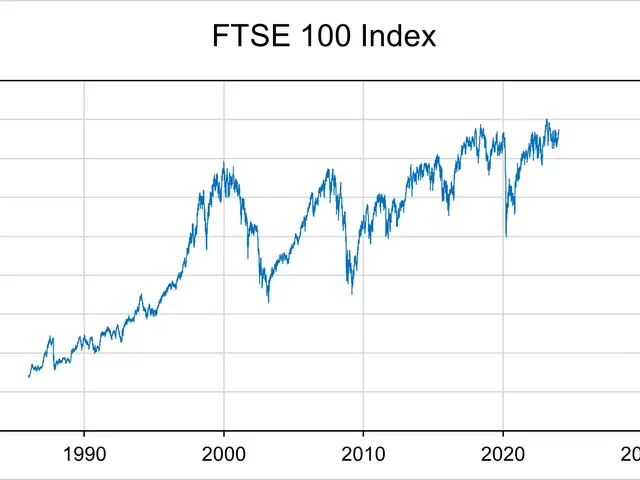

The First Trust Long/Short Equity ETF (FTLS) was launched on 8 September 2014 with a clear goal: to deliver long-term total returns. Unlike traditional funds, it blends long and short stock positions to balance risk and opportunity. Over the past year, however, its performance has lagged behind the broader stock market.

FTLS operates with a net long bias, typically holding 80% to 100% of its assets in long positions and 0% to 50% in short positions. The strategy ensures the fund remains at least 30% net long in the stock market at any given time. It also allocates up to 20% of its assets to futures, either long or short, to enhance returns or hedge risks.

The fund's portfolio currently includes 376 stocks—219 long and 157 short—with a 12-month dividend yield of 1.07%. Despite its diversified approach, FTLS has struggled to keep pace with the S&P 500. Over the last 12 months, it trailed the SPY ETF by 7.8%. Since its inception in September 2015, the underperformance averages 4.4% annualised, though with lower volatility than the broader stock market.

FTLS relies on quantitative models to assess fundamental, technical, and statistical data, including risks tied to accounting practices. This method supports its high turnover rate, which reached 235% in the most recent fiscal year. Investors receive quarterly distributions, but the fund's total expense ratio stands at 1.38%, breaking down into 0.95% for management fees and 0.43% for margin interest and short-position dividends.

FTLS continues to pursue its long-term return strategy through a mix of long and short equity exposure in the stock market. The fund's quantitative approach and active management have not yet matched the performance of passive alternatives like SPY. With higher costs and a complex structure, its future results will depend on market conditions and the effectiveness of its trading models.