Voestalpine Stock: Impressive Market Performance

Voestalpine is upgrading its Donawitz production site in partnership with Italian manufacturer Danieli. The modernisation aims to boost flexibility in the premium steel market. Meanwhile, Erste Group has adjusted its outlook on the company’s stock after a sharp price rally this year.

The Donawitz project will unfold in two stages to keep production running smoothly. Full industrial operation at the upgraded facility is set for early 2027. Voestalpine has not released exact timelines for each phase but confirmed that Wire Rod Austria’s production will relocate temporarily during the work.

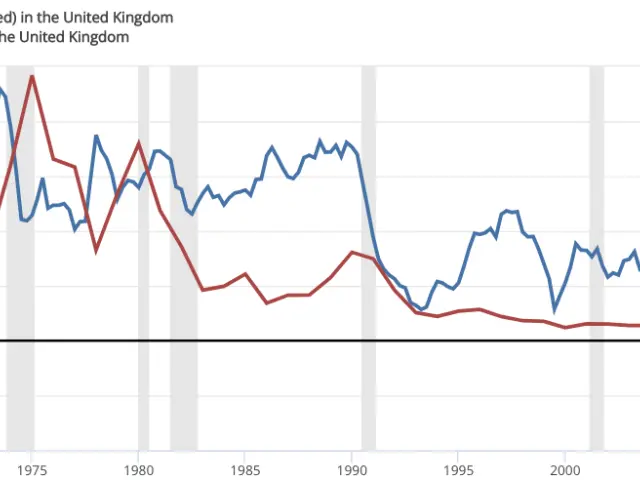

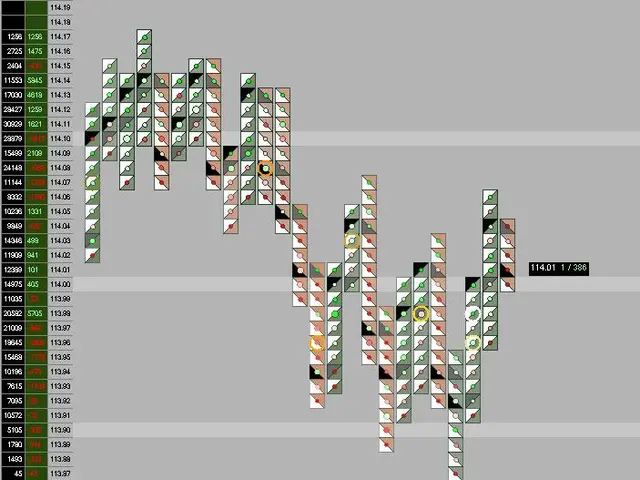

Erste Group recently lowered Voestalpine’s stock rating from 'Accumulate' to 'Hold'. Analysts described the move as a natural response to an overheated rally, with shares up over 104% since January. The bank also raised its price target from €26.50 to €39.50, signalling confidence in long-term growth.

The firm’s dividend is forecast to climb to €1.00 in the coming years. Erste Group noted that a period of consolidation at current levels would be healthy for the stock’s stability.

The Donawitz upgrade will strengthen Voestalpine’s position in high-end steel markets. With the project on track for 2027, the company expects improved operational flexibility. Stock analysts now recommend holding shares after this year’s rapid gains.