Troilus Gold's risky bet on Quebec's untapped gold could pay off—or collapse

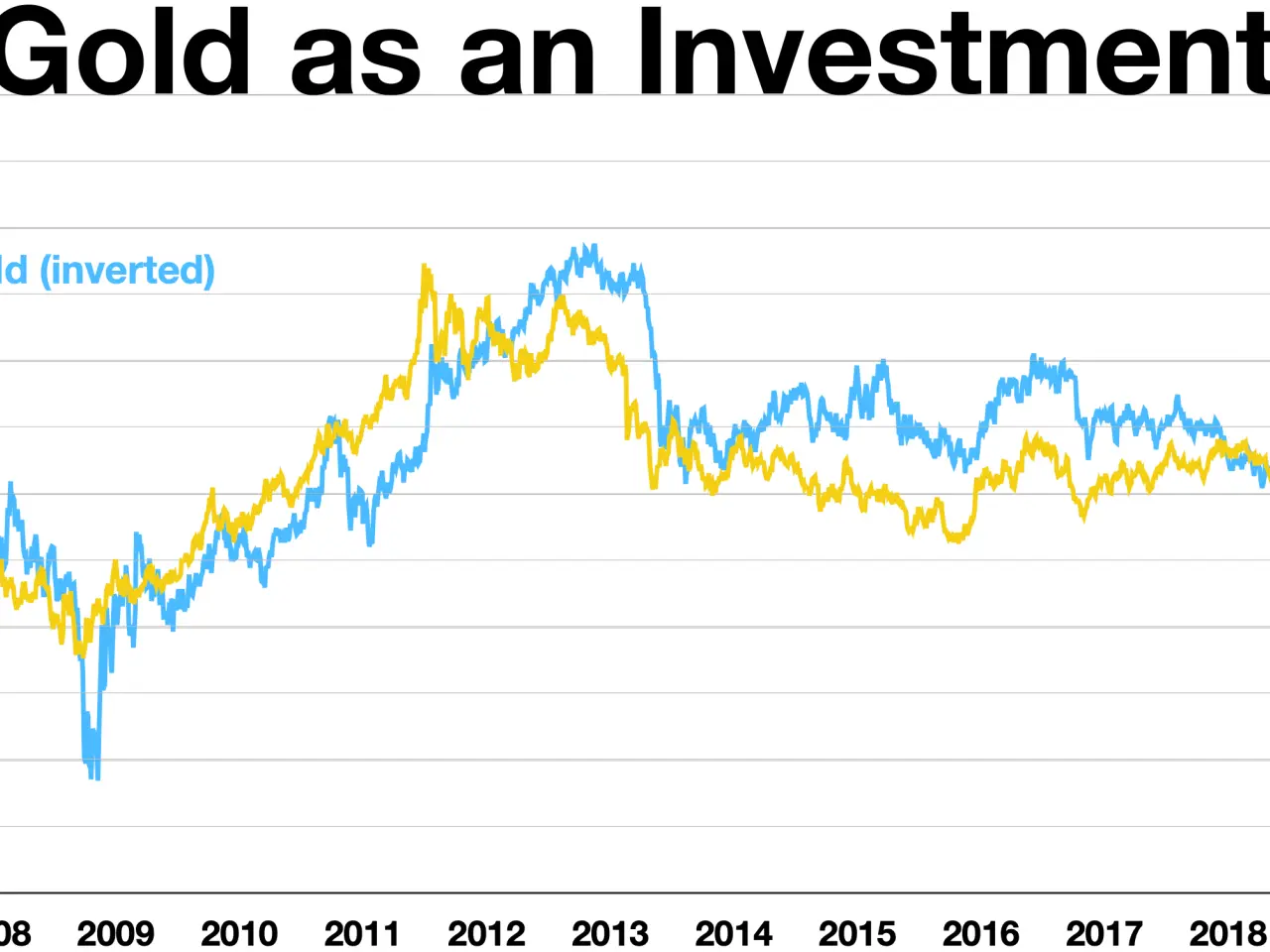

Troilus Gold Corp. has drawn interest from investors seeking high-risk, high-reward opportunities. The company is working to revive an old mine in Quebec, with no active production yet underway. Its stock price could rise sharply—or fall just as fast—depending on exploration results and gold price shifts.

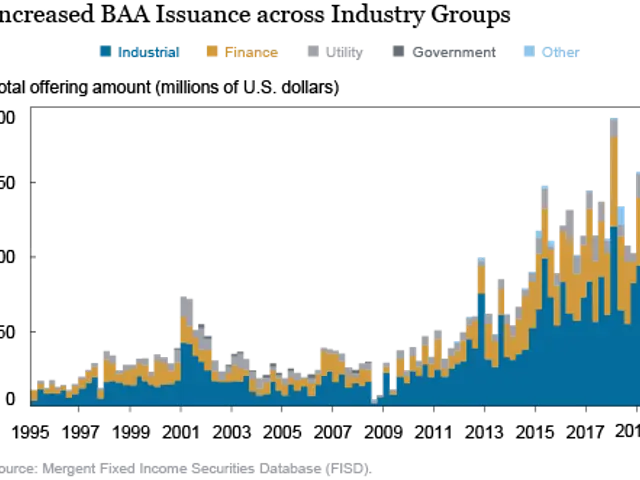

The Troilus project spans 435 km² in Quebec, targeting high-grade mineral deposits in the Southwest Zone and a newly discovered Bear Lake trend. Plans include open-pit mining with a daily throughput of 50,000 tons, backed by $1.3 billion in secured financing.

The company's potential has gained traction on platforms like TikTok and Reddit, where it's been touted as a possible 'multi-bagger' stock. Success could send its value soaring, but setbacks might lead to dilution or steep losses.

Unlike established producers such as Newmont, Troilus carries far greater uncertainty. Its stock swings hinge on drill outcomes and broader stock market movements. Financial experts warn that only investors prepared for volatility—and willing to risk funds they can afford to lose—should consider it.

For novices, larger miners are often recommended as a safer starting point. Speculative traders, however, may see Troilus as a chance for outsized returns, provided they accept the risks involved.

Troilus Gold remains in the exploration phase, with its future tied to project development and market conditions. Investors must weigh the possibility of significant gains against the equal chance of sharp declines. The company's trajectory will depend on upcoming drill results and sustained financing.