Top Picks for Immediate Stock Investments

In the world of stocks, two companies have recently been generating significant interest among investors: Vertex Pharmaceuticals (VRTX) and Amazon (AMZN). While The Motley Fool Stock Advisor analyst team has not included Amazon in their list of the 10 best stocks to buy right now, Vertex Pharmaceuticals has managed to secure a spot.

Vertex Pharmaceuticals, a biotech company specialising in treating cystic fibrosis, is currently experiencing a boost in profitability due to lower royalties on its latest CF therapy, Alyftrek. With an impressive gross margin of 86.08%, the company is practically immune to economic downturns. Despite two recent setbacks – the failure of experimental pain medication VX-993 in a phase 2 clinical study and the FDA not seeing a path forward for obtaining a broad peripheral neuropathic pain label for suzetrigine – Vertex Pharmaceuticals remains a promising pick for long-term investors.

The company's newest CF therapy, Alyftrek, is at least as effective as its top blockbuster drug, Trikafta/Kaftrio, and offers a more convenient once-daily dosing. Moreover, Vertex Pharmaceuticals could file for regulatory approvals for two other drugs next year: Povetacicept for IgA nephropathy and Zimislecel for severe type 1 diabetes.

On the other hand, Amazon, the e-commerce giant, is one of the favorite stocks to buy right now. While it only captures around 1% of the global retail market, there is still room for growth in its e-commerce sector. Amazon's strong moats, such as cost advantages with its e-commerce platform, operational scale, and network effects, help it fend off competition.

Amazon Web Services (AWS) is likely to be one of the biggest winners from advances in artificial intelligence (AI) over the next decade and beyond. The company's CEO, Andrew Jassy, is leading Amazon through this digital transformation.

Peter Lynch, a legendary investor, promotes buying what you know, and Amazon is a company that the author is familiar with. The company has other growth opportunities, including expansion into healthcare, launching a satellite internet service, and positioning itself to be a top player in the U.S. robotaxi market.

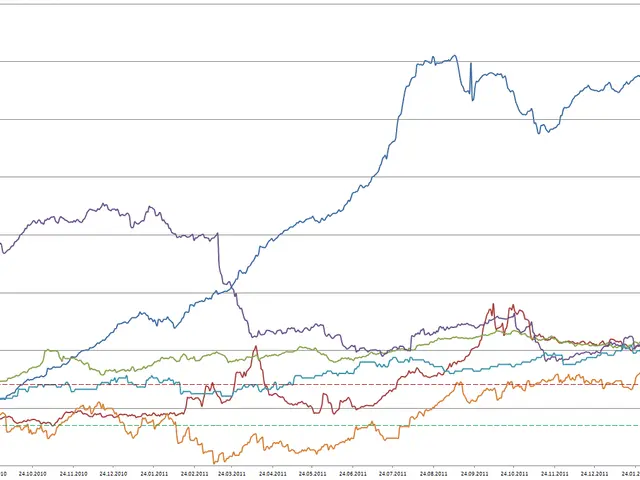

As of the current market, Vertex Pharmaceuticals' shares are down more than 20% below the all-time high set last summer, trading at $391.15. Amazon, on the other hand, continues to soar, with its stock price not disclosed in this article. Both companies offer unique investment opportunities, and it's essential for investors to consider their individual risk tolerance and investment goals when making decisions.