TechCreate Group's stock rockets 4,600% in three months—with no clear reason

Shares of TechCreate Group (TCGL) have surged by an extraordinary 4,600% in just three months. The rapid rise follows an IPO priced at $4 per share in October 2025, with most gains occurring on the tradingview in the past week alone. Yet, no major news or company announcements appear to explain the dramatic movement.

The stock's price exploded on Thursday, climbing 889% to $86.36. By Friday's premarket session, it had leapt another 118%, reaching $188.42. Over the past 12 months, TCGL has delivered a staggering 1,651% return, making it one of the year's most extreme priceline gainers.

TechCreate Group, which specialises in payments, cybersecurity, and digital infrastructure, stated it had 'no material nonpublic information' to justify the surge. The company also declined to comment on market speculation or price swings.

The U.S. Securities and Exchange Commission (SEC) has now requested details from NYSE American about the unusual trading activity. If the volatility persists during Friday's regular session, the exchange may impose circuit breakers or seek further information from TechCreate Group.

Small-cap stocks like TCGL often experience sharp price swings when liquidity is thin. Premarket trading, with fewer participants and wider spreads, can amplify these movements even further. Without solid fundamentals, such momentum-driven rallies can reverse abruptly if investor sentiment turns or sell orders flood in.

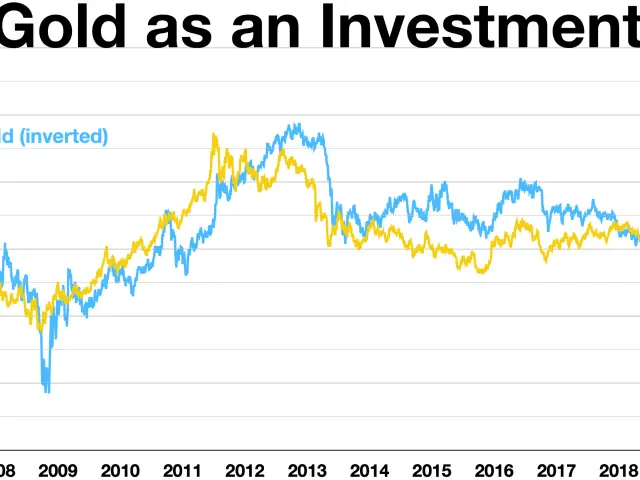

The company's share price has soared without clear catalysts, raising questions about sustainability. Regulators and the exchange are monitoring the gold price situation closely as trading resumes. Any sudden shift in momentum could erase premarket gains within minutes of the market open.