TD Bank faces regulatory pressures as mortgage rates cool loan demand

Toronto-Dominion Bank (TD) is navigating a period of mixed challenges and cautious optimism. While its stock has remained steady, the bank faces pressures from tighter regulations and slower loan growth in key markets.

Analysts are watching closely as TD focuses on digital transformation and operational improvements to strengthen its long-term position.

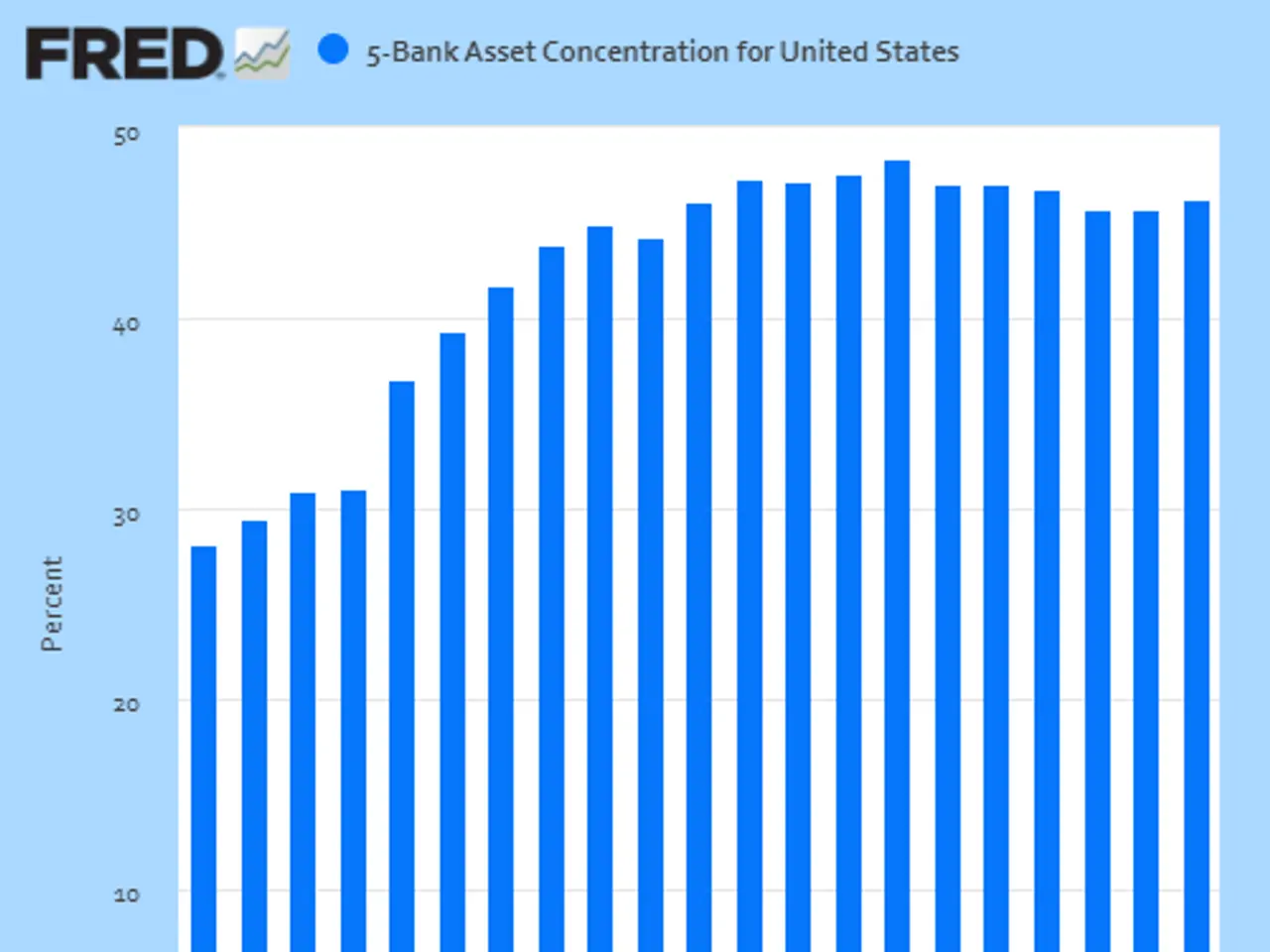

Regulatory changes in North America have increased capital requirements for major banks, including TD. These stricter rules are squeezing profit margins in the short term, adding to the bank's existing challenges.

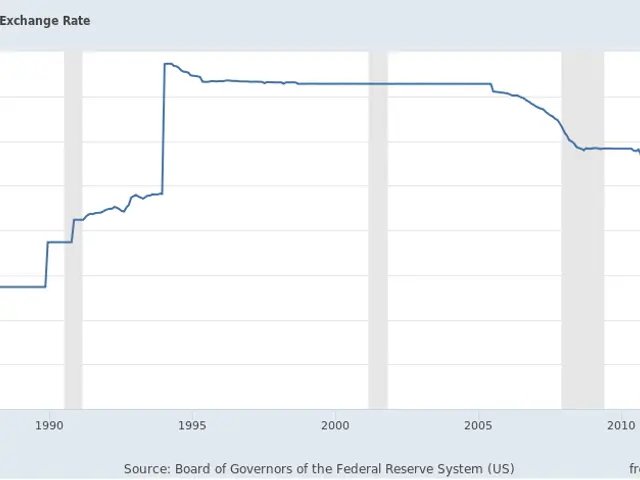

Loan demand has weakened due to high mortgage rates and a cooling real estate market. This slowdown in lending activity is limiting new loan origination, particularly in the U.S. and Canada.

Despite these hurdles, TD is pushing ahead with digitalisation and efficiency upgrades. These efforts could eventually lead to a more positive market reassessment, though the impact may take time to materialise.

Analysts currently hold a neutral to cautiously optimistic view of TD stock. Most price targets sit modestly above current levels, with forecasts clustering between $68 and $72 per share over the next 12 months. Some see potential upside if mortgage rates stabilise and the bank's efficiency drive pays off.

For investors seeking stability, TD remains a solid dividend option within a diversified portfolio. However, its share performance has lacked the volatility seen in high-growth sectors like technology.

Three key factors will shape TD's future: credit quality trends, the ability to sustain dividend growth, and its shift toward a more digitally focused business model.

TD's path forward depends on balancing regulatory pressures with its digital and efficiency goals. If mortgage rates settle and lending activity picks up, the bank could see improved performance.

For now, analysts maintain a measured outlook, with most recommendations falling between 'hold' and 'moderate buy'.