Swiss property market rebounds in 2025 as prices and sales climb

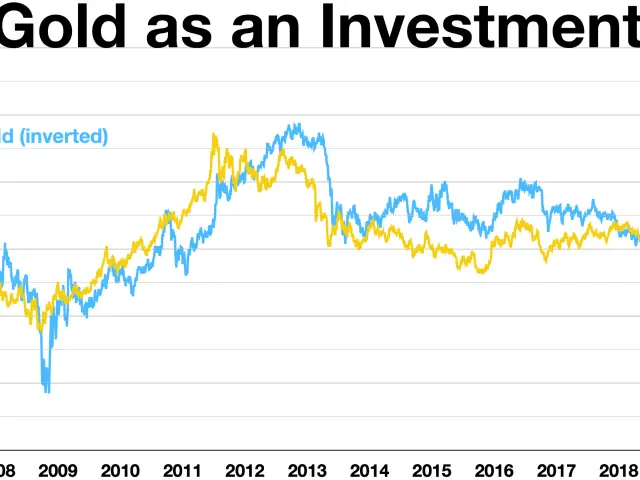

The Swiss property market showed signs of recovery in 2025, with rising prices and increased sales. After a period of uncertainty, both apartments and houses grew in value, while transaction volumes turned positive for the first time in years. Low interest rates and strong demand have played a key role in this shift.

Property prices climbed steadily last year. Apartments saw a 3.1% increase, while house prices rose by 2.4%. The trend extended into 2026, with Basel's average rental prices reaching CHF 25.60 per square metre—a jump of 8.3% since 2021. Zürich and Geneva remained pricier, averaging CHF 29.40 and CHF 28.80 per square metre respectively.

Transaction volumes also picked up in 2025, growing by 7%. This upturn came as borrowing costs eased. The Swiss National Bank (SNB) had lowered its key interest rate to 0% between early 2024 and mid-2025. By 2025, average Saron rates dipped below 1%, and 10-year mortgage rates settled between 1.6% and 1.7%.

Analysts attribute the market's resilience to two main factors. High net immigration has kept demand strong, while slow renewal of housing stock has limited supply. Buying has also become more affordable than renting in many regions, encouraging first-time purchasers. Despite mixed economic forecasts for 2026, low rates continue to support homeownership for now.

The Swiss real estate market is projected to grow by 2% to 3% in 2026. With borrowing costs remaining low and demand outpacing supply, prices and sales volumes are likely to stay on an upward path. The current conditions suggest a stable outlook for buyers and investors in the near term.