Strategies for Maximizing Business Sale Profitability Amidst Private Equity's Slump

In today's business world, a well-crafted data narrative can significantly boost a company's valuation and provide a strong defense during negotiations with buyers, particularly private equity. This is especially important in cases where a sale might be the only option, either as part of a strategic acquisition or to private equity.

The recently passed One Big Beautiful Bill (OBBB) has extended capital gains and estate tax rates, but it has not had a significant impact on sellers. However, the M&A marketplace remains uncertain due to factors such as high interest rates, consumer confidence dips, tariffs, and generational gaps in industries like construction and manufacturing.

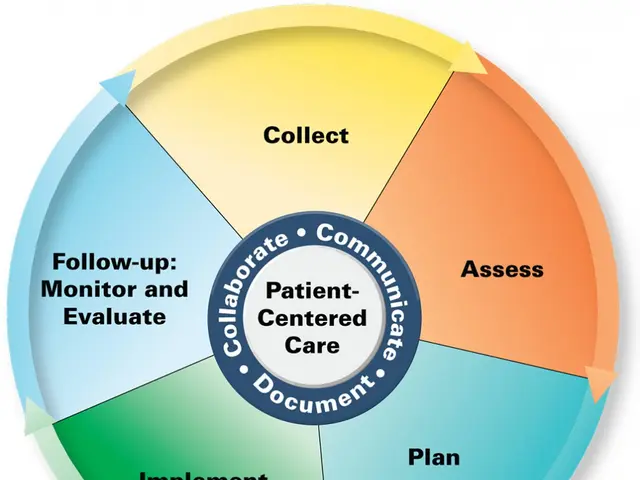

Despite these challenges, the market is far from bleak. Buyers are increasingly interested in businesses whose value is not tied to the owner's talent. Owners should be able to prove that their books are clean, costs are fully measured, and profit margins and operations are in order.

In the United States, the retirement of Baby Boomers and older Gen Xers is leading to a Silver Tsunami, with many of these individuals owning over half of America's private businesses. This presents an opportunity for business owners to consider their exit strategies, especially during uncertain times.

Taking a proactive approach to a sale can improve the odds of a successful exit. For instance, a manufacturer with $5 million to $10 million+ EBITDA could be considered a "platform" purchase for private equity, while a smaller business with $2 million to $3 million EBITDA may be considered only an "add-on".

Understanding how a company will be valued in a portfolio is important for owner-founders who built their companies from the ground up. Similarly, understanding market dynamics, comparative scale, size, and industry is essential for owners to make a successful sales pitch to private equity.

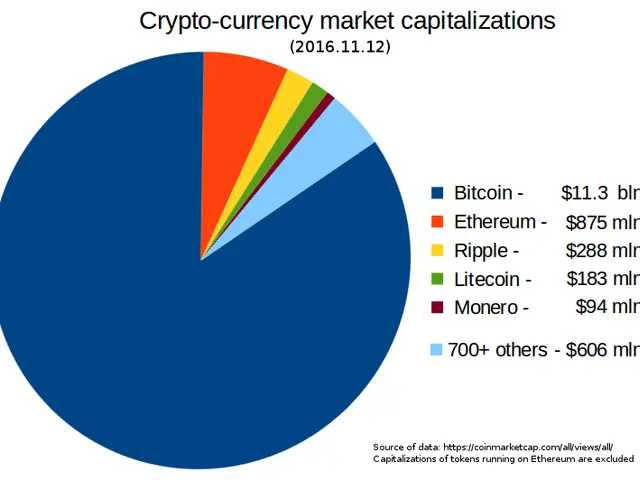

A company with a fully domesticated supply chain is likely to fare better with any seller than one that depends heavily on imports. Despite a positive market outlook, "favorable" conditions for M&A and equity markets have never fully materialized. However, this hasn't stopped private equity firms from buying.

Private equity firms are still actively seeking buyers for medium-sized companies in Germany, particularly Private Equity firms focusing on companies with revenues up to 250 million euros, Family Offices, and specialized investment firms like INBRIGHT and Patron Capital, which invest heavily in niche sectors like Light Industrial and Logistics. These investors emphasize entrepreneurial expertise and sustainable value growth within the German Mittelstand.

In the current market, having a strong narrative is critical to ensuring that a buyer doesn't make erroneous assumptions about a business. The market uncertainty hasn't been as impactful as many business owners feared, with deals still getting done, focusing on high-quality assets. A lucrative sale is still possible, as long as owners are willing to put in the work and hire the right advisers to position their companies appropriately.

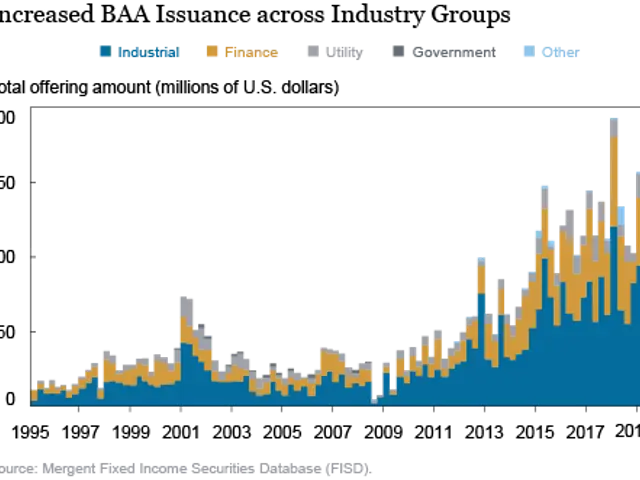

However, business owners are questioning the worth of private equity buyouts for their retirement and succession plans. With private equity firms sitting on an estimated trillion dollars in unsold assets, the value of these buyouts is a topic of ongoing debate. Regardless, private equity firms are still buying, and business owners who prepare their businesses for sale may be able to extract full value, whether they sell to private equity or not.