Stock market in Hong Kong records its largest increase in two weeks, primarily due to a significant rise in Alibaba shares.

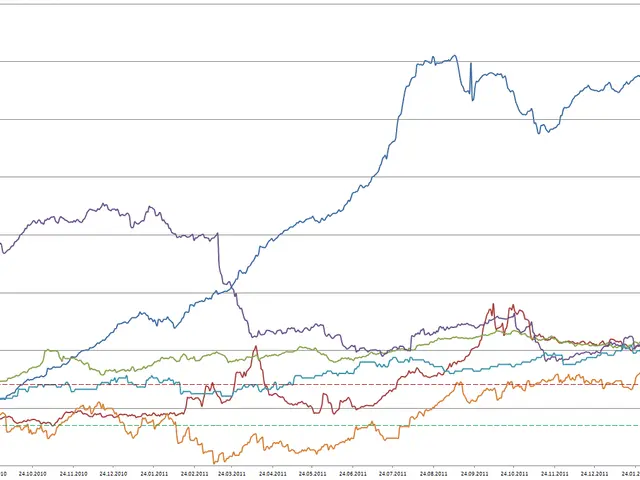

The Hong Kong stock market has witnessed a surge in recent times, with the Hang Seng Index closing at 25,617.42, marking its biggest advance since August 13, with a 2.2% increase. However, the city's benchmark lags behind the yuan-traded shares' performance on mainland exchanges.

The Shanghai Composite Index reached a decade high last month, propelled by the upsurge in yuan-traded shares. The CSI 300 Index, another benchmark of yuan-traded stocks, also saw a 0.6% rise. In contrast, the Hang Seng Index only added 1.2 per cent compared to the yuan-traded stocks' gains.

One of the notable performers in the Hong Kong market was BOC Hong Kong Holdings, which rallied 6.7 per cent to HK$37.58 after first-half profit increased 11 per cent from a year ago. Alibaba also saw a significant gain, surging 78 per cent. Alibaba Health Information Technology advanced 7 per cent to HK$5.84. The Hang Seng Tech Index also saw a 2.2% gain.

Despite some signs of overheating, the stock market regulator endorsed the rally. Wu Qing, chairman of the China Securities Regulatory Commission, stated that the stock markets' stabilization and uptrend need to be further entrenched. However, Mark Cliffe, Chief Strategist at ING in London, expressed concerns about the Fed's dual approach to satisfy both bond and equity markets by manipulating yields and stock prices. Cliffe stated that "the markets do not want to be manipulated by central bankers anymore".

Investors are turning their attention to Hong Kong stocks, but the city's market continues to trail behind its mainland counterparts. The CSI 300 Index gained 10 per cent in the recent period, while the Hang Seng Index did not see a similar increase. The Hang Seng Index is valued at 11.8 times earnings, while the Shanghai Composite Index is valued at 18.2 times earnings, further highlighting the disparity between the two markets.

As the stock market continues to evolve, it will be interesting to see if the Hong Kong market can close the gap with mainland exchanges. The ongoing dynamics of the market will undoubtedly provide ample opportunities for investors to capitalize on.

Read also:

- Zodiac Sign Analysis: Sagittarius - Dates, Traits, and Compatibility with Romantic Partners

- Ohio Establishes Forum to Address Questions Regarding Gambling and Sports Wagering Regulations

- Fifteen Template Designs for Business Pitch Decks to Attract New Customers and Investors

- Launching a lucrative venture in Aerial Photography with Drones