Similarweb's stock crashes 36% after weak earnings and grim outlook

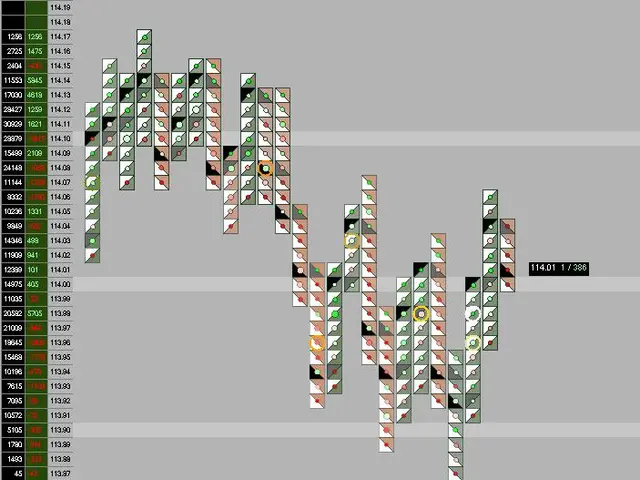

Similarweb's stock hit a record low after the company reported weak earnings and a bleak outlook for the stock market today. Shares dropped 36% to $2.55 on Tuesday, February 17, before falling further to €2.17 ($2.10) the following day. The decline came as investors reacted to missed revenue targets and lowered guidance for the year ahead.

The company's fourth-quarter revenue reached $72.8 million, well below its own forecast of $75.2 million to $78.2 million. Analysts had expected $76.1 million, but Similarweb also fell short on earnings, posting $0.03 per share instead of the anticipated $0.04. Management blamed the shortfall on broader market weakness, execution problems, and two failed contracts with major LLM providers.

Three financial firms downgraded the stock in response. Needham shifted from Buy to Hold, Northland moved from Outperform to Market Perform, and Citizens dropped its Outperform rating entirely. The stock has now lost 55.55% of its value over the past month and sits 81.63% below its 52-week high.

Analysts still project 2026 as Similarweb's first profitable year, with earnings per share forecast at $0.18. However, the company's guidance for the current fiscal year fell below market expectations, suggesting ongoing challenges. Industry experts note that customers are shifting from traditional SEO to AI-driven search, leaving Similarweb in a difficult transitional phase.

Despite strong liquidity and a business model some consider undervalued, the stock is likely to stay under pressure. Investors are waiting for clearer signs of recovery and improved sales performance before confidence returns.

The sharp decline in Similarweb's share price reflects deep concerns over its financial performance and market position. With revenue and earnings missing targets, and analysts lowering their ratings, the company faces an uphill battle. Until sales stabilise and visibility improves, the stock is expected to remain volatile.