Securitisations Resurgence Raises 2008 Crisis Fears

Financial markets are witnessing a resurgence of securitisations, with banks like Capital One and PNC Bank benefiting from reduced capital requirements. However, experts warn of potential risks, as seen in the 2008 crisis. Satyajit Das, author of 'Traders, Guns & Money', among other books, highlights these concerns.

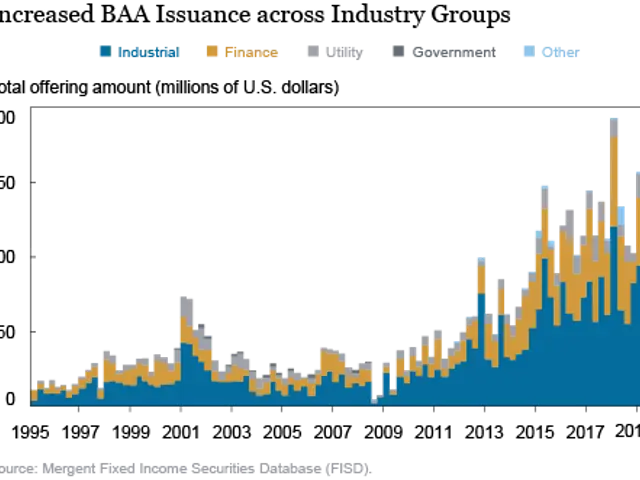

Securitisations allow banks to transfer specific slices of loan portfolio risk to investors, while retaining the first few losses. This practice, prevalent in the 1990s, is making a comeback. Banks like Bank of America (BOA) can now increase lending and boost returns, thanks to reduced capital needs.

However, the extent of credit risk mitigation remains uncertain. Originating banks still hold the riskiest element - exposure to first losses. Moreover, these products, including synthetic risk transfers (SRTs) and collateralised loan obligations (CLOs), are identified by the IMF as potential sources of vulnerabilities.

The collateral used for borrowings, often AAA and AA-rated securities, could trigger margin calls in case of defaults. These products, essentially rebadged securitisations, may not function as intended, as seen in the past. Today, transactions involve riskier assets like leveraged loans and subprime debt, raising alarms.

Complex circularities exist. Banks may invest in or provide loans to private credit funds involved in securitisations. This interconnectedness could amplify risks if the market for these products is disrupted, potentially disguising banks' weaknesses.

The lowering of systemic capital available against default, as risk shifts to unregulated shadow banks, raises concerns. While securitisations offer benefits, their risks must be carefully managed. The IMF's warnings and the experiences from the 2008 crisis serve as reminders of the potential pitfalls. Regulators and market participants must remain vigilant to ensure the stability of the financial system.