Rock Tech Lithium’s stock plummets as sell signals flash red

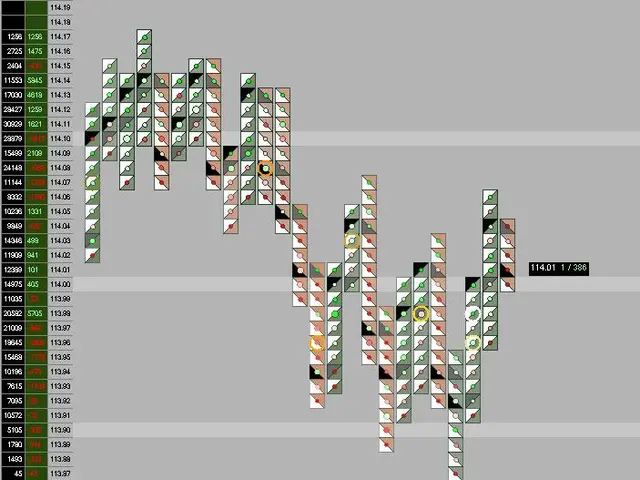

Shares of Rock Tech Lithium have taken a downturn, with recent stock market indicators suggesting a sell. The stock's price plummeted on November 7, sparking concerns about the company's future.

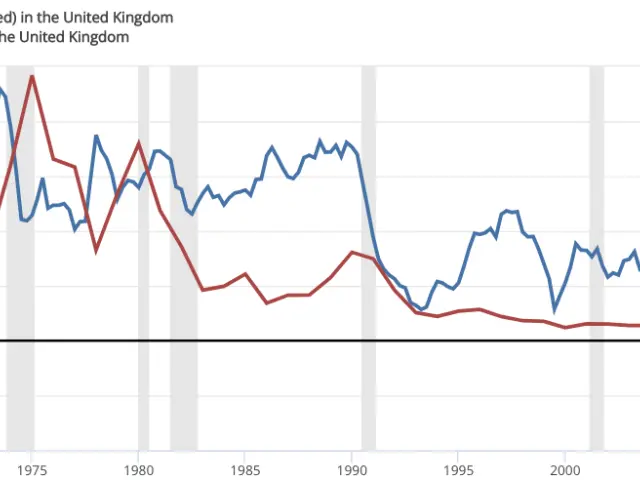

The technical chart outlook for Rock Tech Lithium has worsened, with both short-term and long-term moving averages pointing towards a sell. The stock has breached its 50-day moving average, indicating a sustained downward trend.

Market capitalization has dwindled to approximately CAD 94 million, reflecting the company's diminished value on the stock market today. Rock Tech Lithium is currently not generating any revenue and is burning through cash, with a debt-to-equity ratio of 2.05. This financial strain raises questions about the company's ability to maintain its operations.

Despite positive analyst recommendations from Canaccord Genuity in November 2021, which cited institutional support from BlackRock and The Vanguard Group, Rock Tech Lithium's recent performance has been lacklustre. Investors may want to closely monitor the situation as the company navigates its current challenges on the stock market today.