PECO reports record growth with $111.3 million net income in 2025

Phillips Edison & Company (PECO) has released its financial results for 2025, showing strong growth in income and property performance. The company reported a net income of $111.3 million for the full year, alongside record occupancy rates across its shopping center portfolio.

For the fourth quarter of 2025, PECO recorded a net income of $47.5 million, or $0.38 per diluted share. Core Funds From Operations (FFO) reached $91.1 million, or $0.66 per diluted share, while Nareit FFO came in at $88.8 million, or $0.64 per diluted share. Over the full year, Nareit FFO per share climbed 7.2% to $2.54, with Core FFO per share rising 7.0% to $2.60.

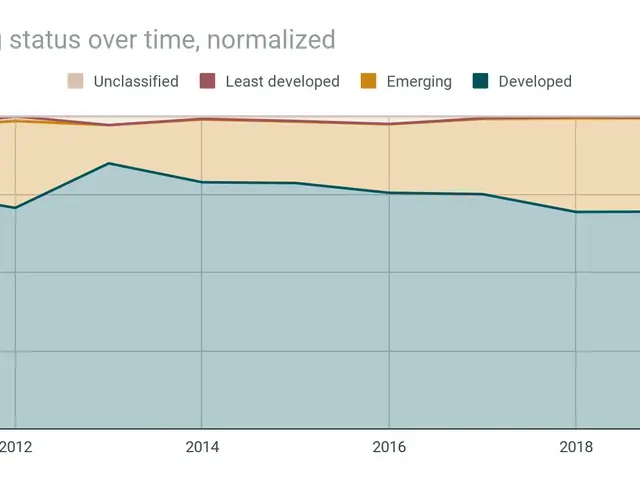

The company's leased inline occupancy hit a new high of 95.1%, while overall leased portfolio occupancy stood at 97.3%. Same-center leased occupancy reached 97.6%, reflecting steady demand. Net Operating Income (NOI) for same-center properties grew by 3.2% in the quarter and 3.8% for the full year.

PECO continued its strategy of acquiring grocery-anchored shopping centers, particularly in high-growth Sun Belt regions like Florida, Texas, and the Carolinas. Over the past three years, the company has focused on areas with strong population growth, low vacancy rates, and stable grocery demand. In 2025 alone, PECO acquired $395.5 million in assets while selling $145.4 million worth of properties.

The results highlight PECO's expansion in key markets and improved financial performance. With higher occupancy rates and increased FFO, the company has reinforced its position in necessity-based retail. The focus on grocery-anchored centers in growing regions remains central to its strategy.