Osisko Development’s Bold Bet on Gold Lures Risk-Taking Investors

Osisko Development Corp. has become a hot topic among investors looking for high-risk, high-reward opportunities in the gold sector. The company, led by Chairman and CEO Sean Roosen, focuses on advancing the Cariboo Gold Project in central British Columbia, Canada. Its stock, trading under the ticker ODV, has drawn attention for its volatility and speculative appeal.

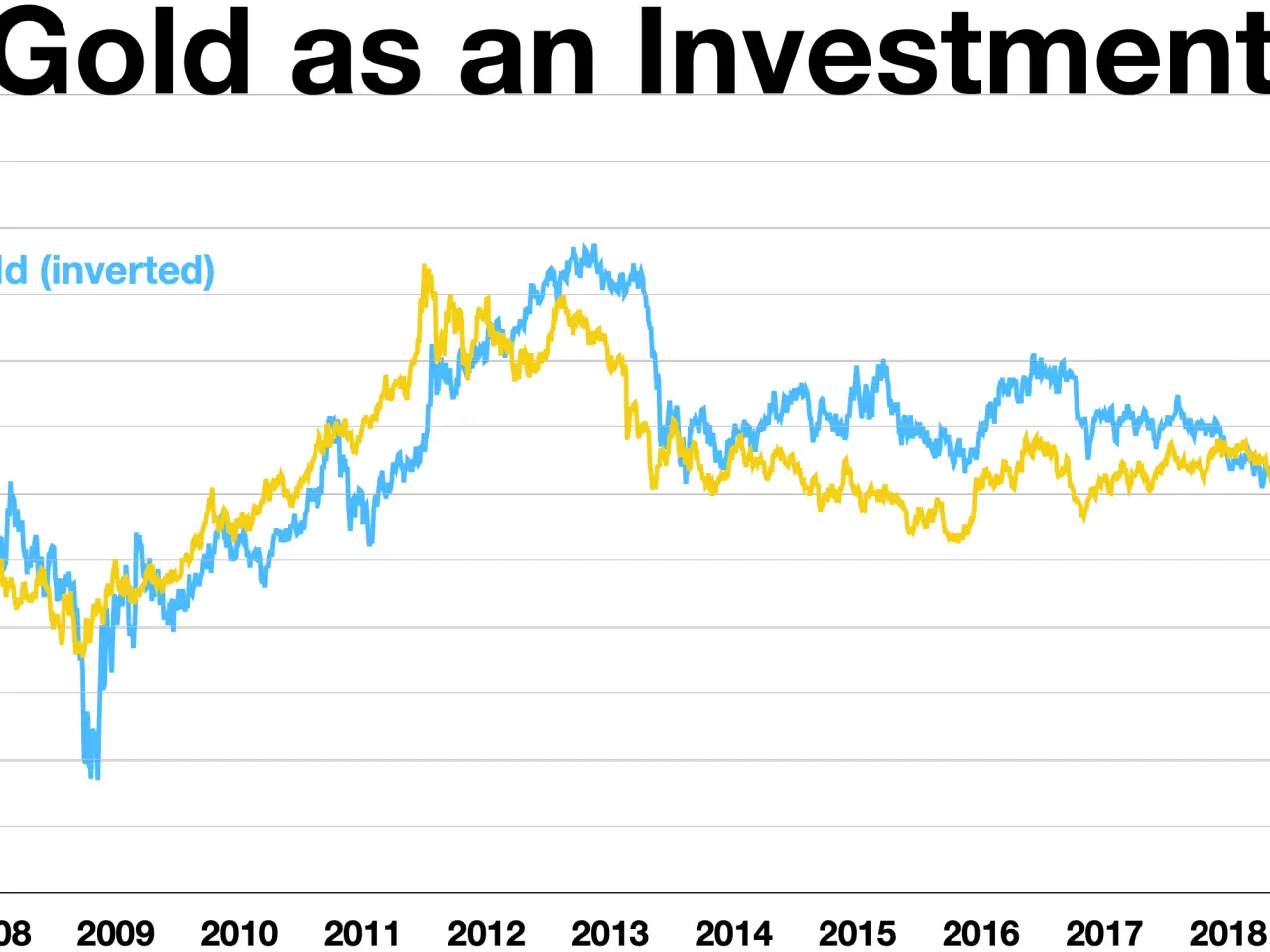

The company’s concentrated business model centres on gold projects in North America, attracting investors who anticipate rising gold prices or seek portfolio hedges. Unlike established gold producers, Osisko Development remains a smaller, more speculative player, offering higher potential returns but also greater risks.

The stock’s performance swings sharply with gold prices and broader commodity market sentiment. This volatility creates opportunities for experienced traders to profit from short-term price movements. However, the same unpredictability makes it less suitable for beginners or those prioritising stable dividend stocks. On social media and stock market forums, ODV has gained a strong following. Some investors speculate it could become a tenbagger—a stock that grows tenfold—while others caution about the substantial risks tied to project execution and budget control. Analysts note that Osisko Development’s success hinges on the Cariboo Gold Project’s progress. Any delays or cost overruns could significantly impact the company’s valuation, reinforcing its status as a high-stakes investment.

For investors willing to accept elevated risk, Osisko Development presents an intriguing option in the gold sector. The stock’s volatility and dependence on gold prices mean it remains a speculative choice rather than a stable long-term hold. Those considering it should weigh the potential for outsized returns against the likelihood of significant fluctuations.