Oracle Stock Surges 36% After Earnings, Analysts See Entry Opportunity

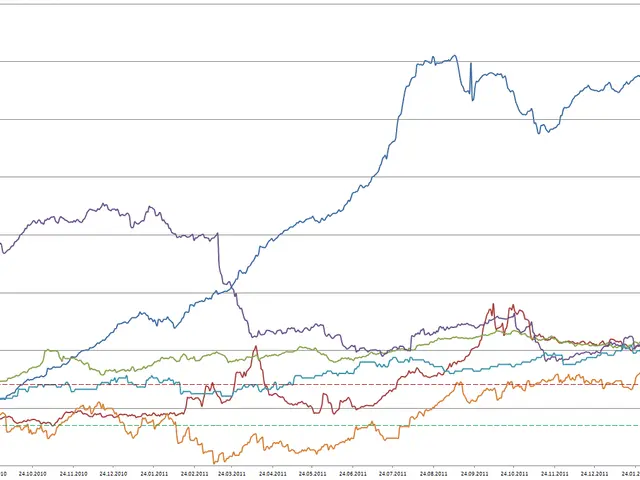

Oracle's stock has seen a rollercoaster ride recently, with bears dominating the stock market since last week, pushing prices down to $281.24. Despite this, the stock has surged by up to 36% following its latest earnings report, with analysts eyeing a potential entry opportunity during the current stock market pullback.

Oracle's stock began last week under bearish control, with prices plummeting to $281.24. After an initial sell-off to $291.75, the stock rebounded to $329.50 but remained below its earnings high of $345.72. Significant profit-taking has been observed since these initial gains. Remarkably, Oracle's stock has soared by as much as 36% following its latest earnings report, with gains reaching a high of 43% at one point.

Analysts are now considering the current stock market pullback as a potential good entry opportunity. The stock is continuing to fill the gap created by the earnings and is heading towards the 50-day moving average (SMA50) at $260. The average price target of analysts is $337.42, indicating an upside potential of nearly 20%. The decline from the record high is now over 18%. If the gap is completely filled, the price would need to retreat to the pre-earnings high of $243.49.

Oracle's stock has experienced significant volatility recently, with bears pushing prices down and analysts seeing potential in the current stock market pullback. As the stock continues to fill the earnings gap and approaches the SMA50, investors await further developments in Oracle's financial activities to influence market sentiment and analyst views.