OceanaGold's stock surges 30% as gold prices hold above $2,500 per ounce

OceanaGold has become a hot topic among investors over the past year. The mining company, which operates gold and silver projects across the Philippines and the U.S., saw its stock price climb by roughly 25-30%. Social media platforms like TikTok and YouTube have also fuelled interest, with many touting it as a high-potential investment.

From February 2025 to February 2026, OceanaGold's shares (TSX: OGC) rose from around CAD 2.80 to CAD 3.60. The surge came as gold prices stayed above $2,500 per ounce, boosting the company's earnings. Strong production at its Philippine and U.S. mines further supported the growth, while positive analyst reviews added to investor confidence.

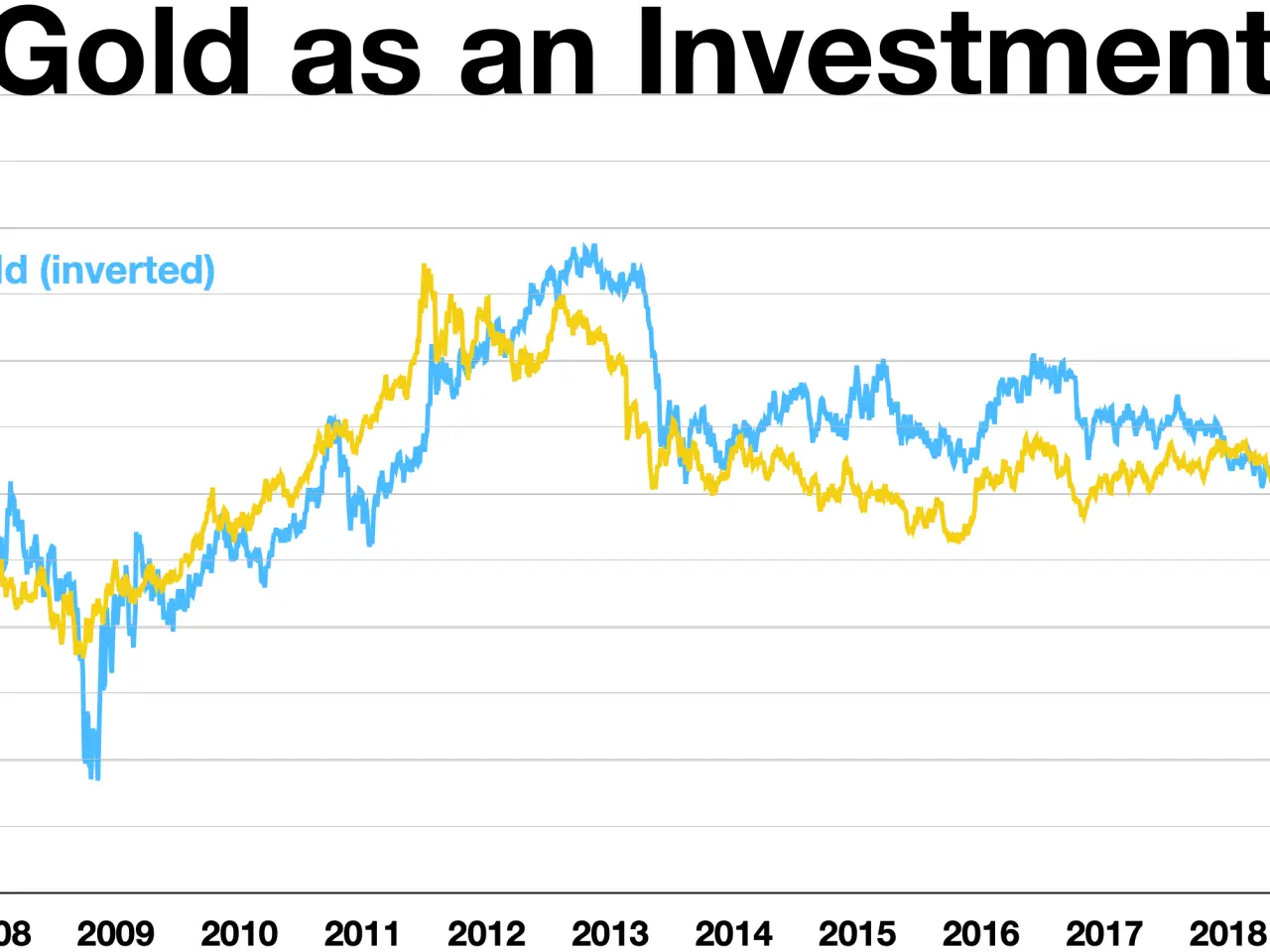

Gold's reputation as a safe haven during economic uncertainty has made OceanaGold particularly attractive. Unlike larger firms such as Barrick Gold or Newmont, OceanaGold offers leveraged exposure to gold prices, meaning its stock can rise more sharply when gold gains value. However, this also makes it riskier, as its smaller size leaves it vulnerable to sudden price swings.

While the company's recent performance has drawn attention, financial experts warn that investing in OceanaGold is not without risk. Speculative investments like this require careful research, as market shifts can lead to significant losses as well as gains.

OceanaGold's stock growth reflects both strong gold prices and increased investor interest. The company's smaller scale allows for higher potential returns but also exposes it to greater volatility. For those considering an investment, understanding the risks remains essential before committing funds.