Nigerian Stock Market Surges 18.95% in Q3 2025, Led by Nigerian Enamelware's 108.65% Gain

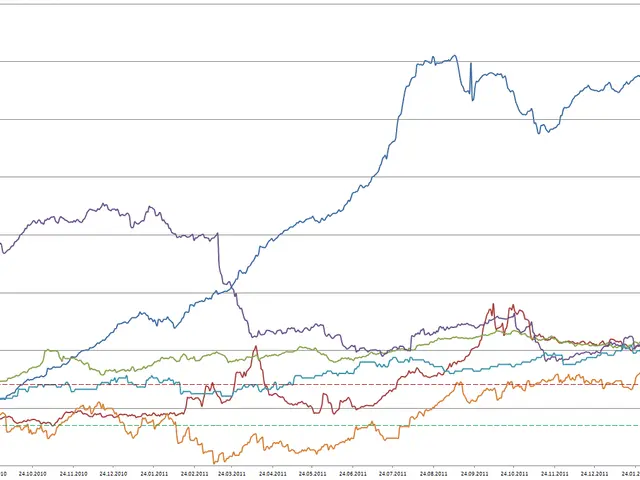

The Nigerian stock market today experienced a remarkable surge in the third quarter of 2025, with the All-Share Index gaining 22,731.9 points to close at 142,710.5 points. This impressive performance, an 18.95% return to investors, marks the strongest quarter since 2020.

Nigerian Enamelware Plc was among the top performers in the stock market today, ranking 10th with a staggering 108.65% gain. The company's stock opened at N18.50, traded a substantial 4.47 million shares, and closed at N38.60 after crossing the N30 mark. This remarkable rally follows a turnaround for Nigerian Enamelware, which swung from a N2.5 billion pretax loss in 2024 to a N24.9 million profit in 2025. This transformation was driven by clearing bad debts and improved material sourcing strategies.

The third quarter was particularly strong, with July 2025 leading the way, driving a 16.57% gain across all sectors in the stock market today. The top 10 stocks that fueled this rally were led by Mutual Benefits Assurance, which achieved an impressive 248.18% gain. The NGX Insurance Index led the sectoral performance with a 57.65% surge, followed by Industrial Goods at 39.32% and Consumer Goods at 27.89%.

Year-to-date, Nigerian Enamelware's stock has surged over 119%, reflecting a significant recovery and growth. The company's strong performance, coupled with the broader stock market's robust rally, signals a positive outlook for the Nigerian stock market today.