MarketAxess Shares Plummet Despite Beating Q2 Estimates

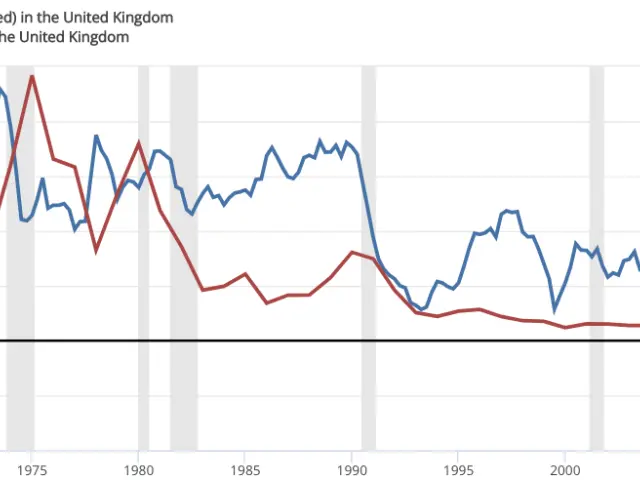

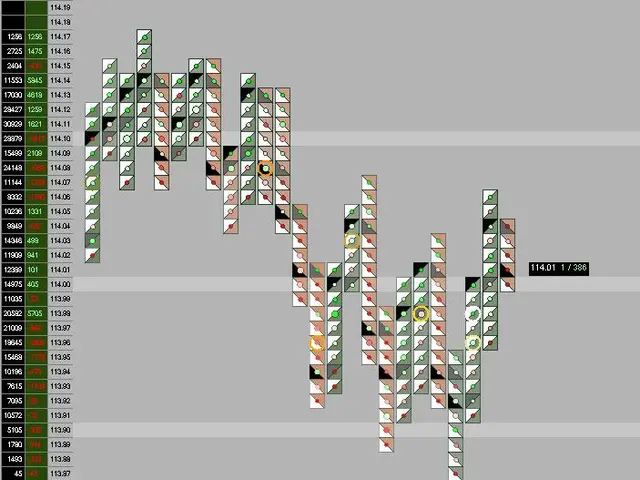

MarketAxess Holdings Inc. (MKTX) shares plummeted 10.1% in the trading session following its Q2 results on Aug. 6, despite exceeding revenue and EPS estimates. The stock has been on a downward trend, dropping 40.8% over the past 52 weeks, underperforming XLF and S&P 500 Index returns. MKTX is set to announce its third-quarter results on Friday, Nov. 7.

MKTX operates an electronic trading platform for institutional investors and broker-dealer companies worldwide. In Q2, the company's adjusted EPS soared 16.3% year-over-year to $2, surpassing consensus estimates by 3.1%. Revenues grew 10.9% year-over-year to $219.5 million, also beating Street's expectations by 59 bps. However, the stock price reacted negatively to the results, indicating that investors may have had different expectations.

Analysts expect MKTX to report a non-GAAP profit of $1.70 per share in Q3, down 10.5% from the year-ago quarter. For fiscal 2025, MKTX is projected to report an adjusted EPS of $7.27, slightly down from $7.28 in fiscal 2024. Looking ahead, MKTX's earnings are anticipated to surge 9.9% year-over-year to $7.99 per share in fiscal 2026.

MarketAxess Holdings Inc. (MKTX) is valued at $6.4 billion by market cap. Despite strong financial performance in Q2, the stock price reacted negatively, indicating potential concerns among investors. As MKTX prepares to announce its election results on Nov. 7, investors will be watching closely to see if the company can reassure the market and reverse its recent stock price decline.