Loomis Stock: Solid Figures

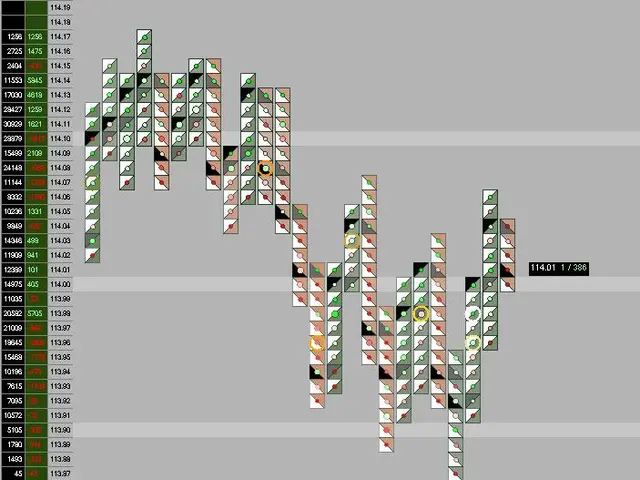

Loomis has released its latest financial results, showing steady growth and improved profitability. The company’s stock closed at SEK 382.80 on December 19, 2025, following a strong third-quarter performance. Shareholders will also benefit from a dividend of SEK 14.00 per share.

In the third quarter, Loomis reported revenue of SEK 7.64 billion, marking organic growth of 3.9%. The company’s net income for the same period reached SEK 528 million, equivalent to SEK 7.80 per share. Operating cash flow also remained robust at SEK 978 million.

Cost control and efficiency measures contributed to a higher pre-tax profit compared to 2024. The operating margin (EBITA) for the quarter stood at 13.2%, reflecting improved profitability. Over the trailing twelve months (TTM), Loomis recorded revenue of approximately SEK 30.85 billion and a pre-tax profit of SEK 2.48 billion. The dividend of SEK 14.00 per share offers a yield of 3.66%, providing returns for investors. Analysts noted the company’s ability to maintain growth while managing costs effectively.

Loomis’ latest results highlight its financial stability and consistent performance. With steady revenue growth, strong margins, and a solid dividend, the company continues to deliver value to shareholders. The stock price reflects confidence in its ongoing strategy.