Legal & General Debuts ESG-Focused Short-Term Emerging Market Bond ETF

Legal & General has launched a new ETF focused on short-term emerging market sovereign bonds. The L&G ESG EMGB0-5Y EOA aims to provide yield potential while limiting exposure to stock market shifts. It targets bonds with maturities of five years or less, appealing to investors wary of longer-term risks.

The ETF tracks the J.P. Morgan ESG EMBI Global Diversified Short-Term Custom Maturity Index. This benchmark applies strict sustainability filters, leading to notable differences from traditional indices. Countries with poor ESG scores are either excluded or given lower weightings.

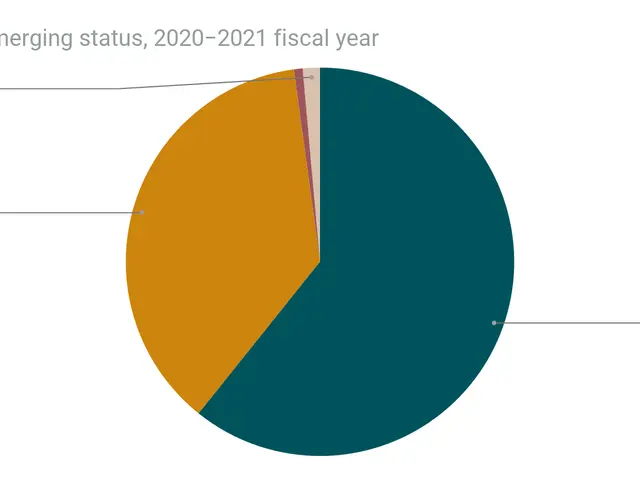

Recent adjustments reflect shifting sustainability ratings. Over the past two years, Argentina's ESG score jumped from 25 to 48 on the MSCI scale, earning it a place in the ETF in early 2026. Its inclusion raised the fund's emerging market bond allocation by 1.2%. Meanwhile, Hungary's score fell from 32 to 28, reducing its weight by 0.8%, while Poland's steady rating kept its share unchanged.

The fund's performance hinges on economic and political conditions in its core regions. Argentina, Poland, and Romania currently dominate the portfolio. Investors are advised to watch credit ratings closely, as these countries carry higher risk profiles.

The index rebalances monthly, with the next review due in late February 2026. Its short-duration focus makes it less vulnerable to stock market shifts than broader bond benchmarks.

The L&G ESG EMGB0-5Y EOA offers a blend of yield potential and reduced rate sensitivity. Its sustainability-driven approach reshapes exposure, favouring countries with improving ESG metrics. The next rebalancing will further adjust allocations based on updated ratings and stock market conditions.