Intel bets big on AI in mobile networks despite revenue slump and China struggles

Intel has reported a challenging end to 2025, with revenue falling to $13.7 billion in the last quarter—a 4% drop from the previous year. The company is now pushing ahead with new AI and manufacturing projects while facing supply issues in key markets. A major boost came from NVIDIA, which invested $5 billion in Intel's common stock to strengthen its financial position.

Intel's latest strategy centres on embedding AI directly into mobile networks. The goal is to improve efficiency, cut data congestion, and deliver more stable real-time connections. According to the company, this approach will also reduce operational costs for network providers while enhancing service quality.

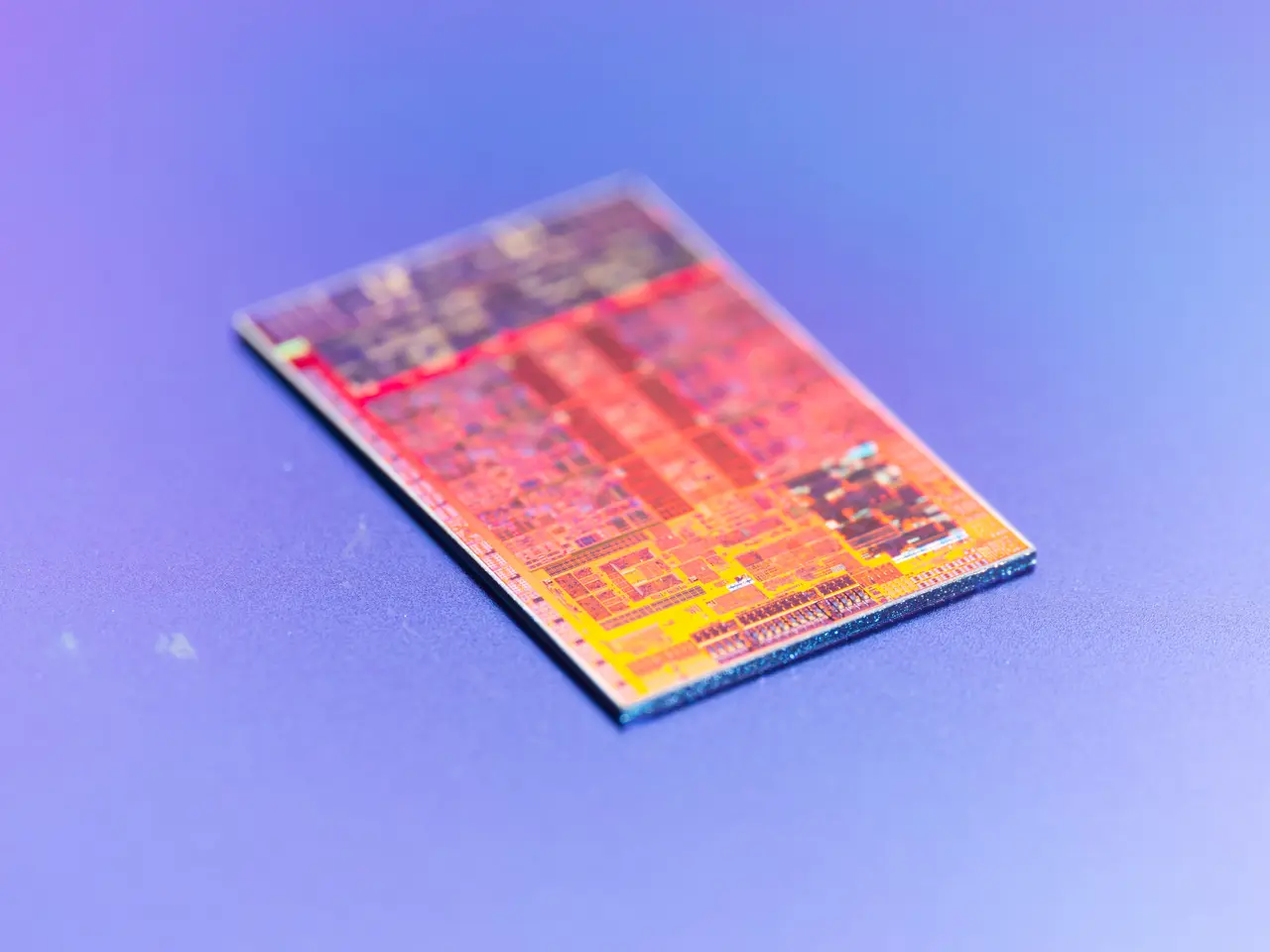

At Mobile World Congress 2026 in Barcelona, Intel will showcase its newest AI advancements. Cristina Rodriguez, vice president and general manager of the Network & Edge Group, will take the Marconi Stage to discuss how edge AI can enable real-time intelligence across industries. The company is also developing an air-cooled GPU for AI inference and expanding production with its Intel 18A process.

Meanwhile, Intel's stock remains under pressure due to shortages of Xeon server processors, particularly in China. The issue stems from limited production capacity and low buffer stock, not weak demand. Since mid-2025, demand for Xeon servers in China has plunged by 30-40% compared to the previous year. US export restrictions and a shift to domestic alternatives, such as Huawei's Kunpeng processors, have driven the decline. In contrast, demand in the US and Europe has stayed stable or grown modestly by 5-10%. The strongest demand in China now comes from state-backed AI and cloud firms like Alibaba Cloud and Tencent, as well as government data centres in Beijing and Shanghai.

Intel's $5 billion investment from NVIDIA provides financial support as it navigates supply challenges and declining revenue. The company's focus on AI-driven mobile networks and new hardware could help it regain momentum. However, ongoing restrictions and market shifts in China continue to impact its server business.