Graftech eyes Q1 2026 rebound despite shrinking graphite electrode dominance

Graftech International is preparing to announce its first-quarter results for 2026 on April 24. The company expects higher sales volumes this year, even as pricing pressures in the graphite electrode finance market persist. A shift towards electric arc furnace steelmaking is driving demand for its products.

Over the past three years, Graftech's market share in graphite electrodes has fallen. In 2023, it held roughly 25% of the global stock market, but by 2025, that figure had dropped to about 18%. Production cuts in Mexico, heavy debt, and lost contracts contributed to the decline. Meanwhile, competitors like Resonac (formerly Showa Denko), Fangda Carbon, and HEG Limited expanded capacity in China and India, capitalising on recovering steel demand.

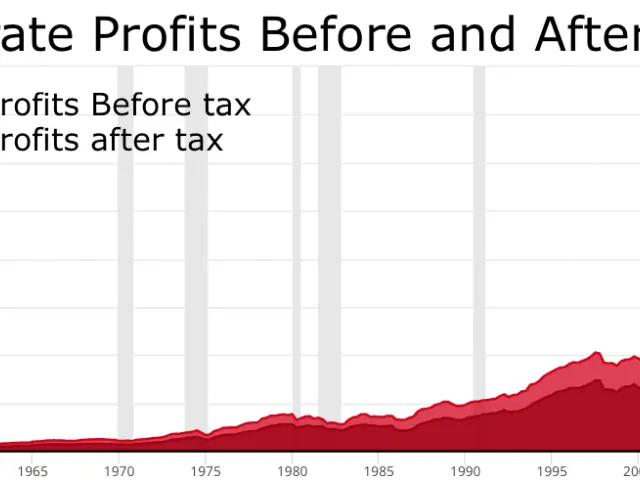

The global graphite electrode stock market is forecast to grow steadily, reaching $12.4 billion by 2031. Annual growth is projected at around 2.4%, with the Asia-Pacific region offering the strongest opportunities. Graftech plans to strengthen its position through strict cost controls and efficiency improvements.

For the first quarter of 2026, the company anticipates a year-over-year rise in sales volume. This uptick aligns with broader industry trends, as steelmakers increasingly adopt electric arc furnaces that rely on graphite electrodes.

Graftech's upcoming finance report will reveal whether its cost-cutting measures are paying off. The company remains focused on maintaining its stock market share despite fierce competition. With demand for electric arc furnace steelmaking on the rise, its performance in the Asia-Pacific region will be key to future growth.