Gerresheimer stock plunges as major bank exits and support weakens

Gerresheimer Stock: Major Bank Exits

For Gerresheimer shareholders, the 2025 stock market year is a test of patience. In addition to the already tense chart situation, the stock came under fire from two sides on Friday: A direct competitor disappointed with its outlook, while a major French bank announced its withdrawal from voting rights. The Ger...

2025-12-06T00:57:18+00:00

finance, investing, stock-market

Gerresheimer’s stock has suffered a sharp decline in 2025, dropping 63.16% since January. The company now faces additional pressure after a major shareholder cut its voting rights to zero. Investors are watching closely as the share price hovers near its yearly low.

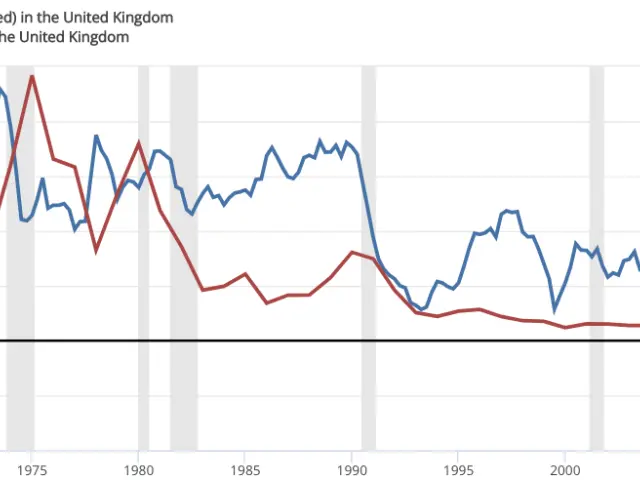

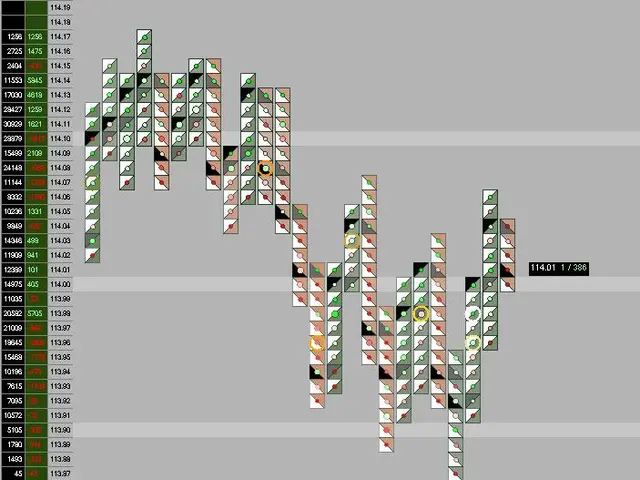

The stock closed at €25.86 on December 6, 2025, marking a 1.52% daily loss. This brings it dangerously close to the €25 support level, with analysts warning of a potential drop to €23.50 if that threshold breaks. The decline follows a broader downtrend, with shares now 44% below their 200-day moving average.

Gerresheimer’s struggles worsened after competitor Schott Pharma issued a gloomy forecast for 2026. The negative outlook from a key industry player weighed on investor confidence. Adding to the pressure, BNP Paribas reduced its voting rights in Gerresheimer to 0.00%, a move that further unsettled the market.

Technical indicators also signal trouble. The Relative Strength Index (RSI) recently hit an oversold extreme of 17.7, reflecting heavy selling momentum. Over the past 12 months, the stock has plummeted by 65.63%, deepening concerns about its future performance.

The company now risks demotion from the MDAX, which could trigger another wave of selling. With the stock already near its 52-week low, analysts are monitoring whether it can hold above €25. A further drop would extend the steep losses seen throughout 2025.