Franklin Resources expands with $3.5B private equity surge and new leadership

Franklin Resources has made several key financial moves in recent months. Its private equity arm, Franklin Lexington, has grown rapidly, while the company has adjusted dividends for shareholders. Leadership changes and new partnerships have also marked this period of expansion.

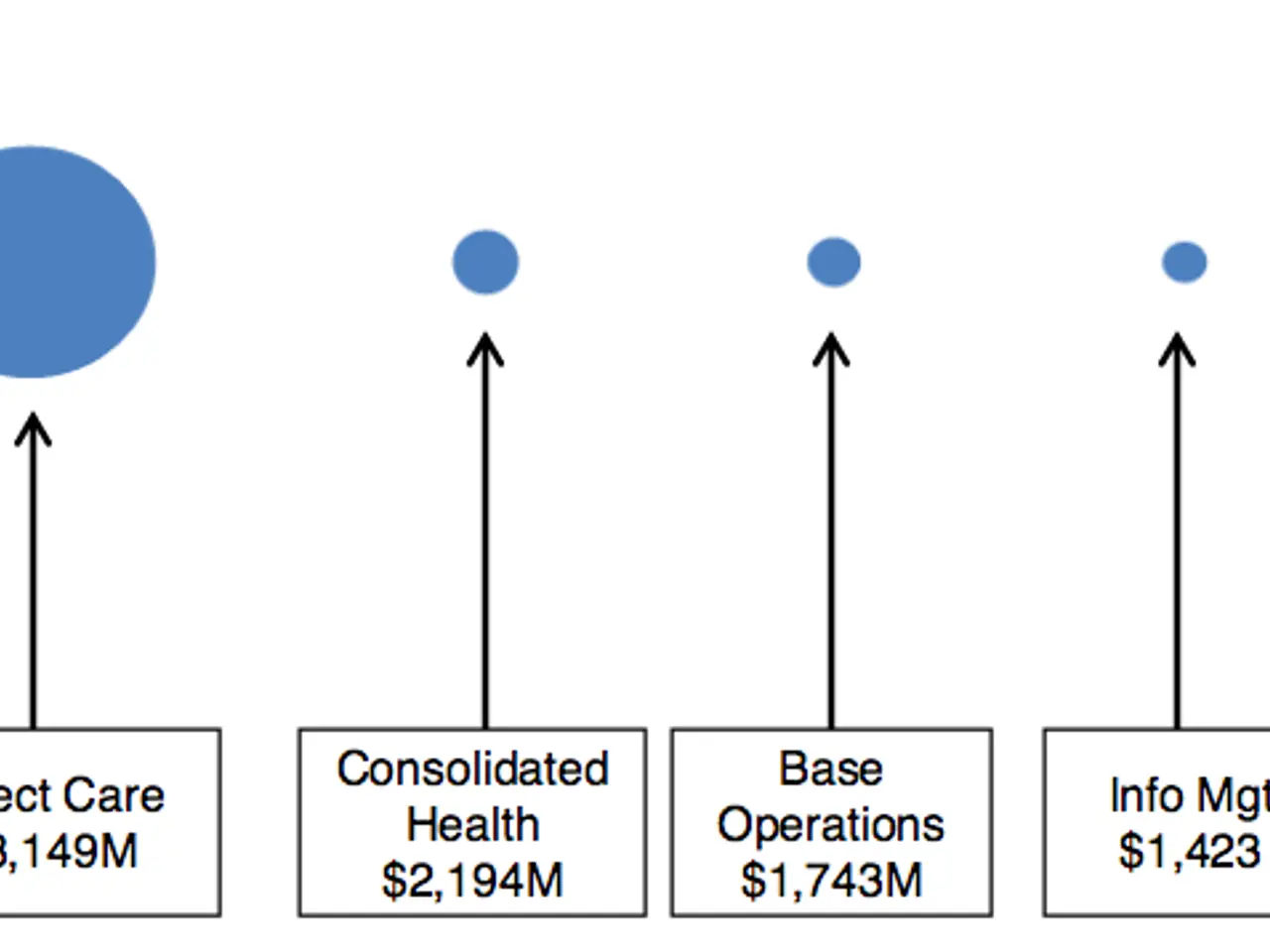

Franklin Lexington, the private equity division of Franklin Resources, hit $3.5 billion in assets under management. This milestone arrived within its first year, signalling strong progress in private markets.

The parent company has also raised its quarterly dividend to $0.33 per share. Shareholders will receive the increased payment on April 10, 2026. Meanwhile, Franklin BSP Realty Trust (FBRT), another subsidiary, reset its dividend to $0.20 per share.

In leadership updates, Michael Comparato took over as CEO of FBRT, replacing Richard J. Byrne. The company has also entered a partnership with Binance, allowing tokenised fund shares to serve as collateral on the crypto exchange.

Franklin Resources continues to expand its financial services through private equity growth, dividend adjustments, and strategic partnerships. The company's recent decisions reflect a focus on diversification and digital asset integration. No updated figures on market capitalisation or stock performance have been released since the $3.5 billion milestone.