Dow Jones slips below 48,000 as holiday trading thins before New Year’s pause

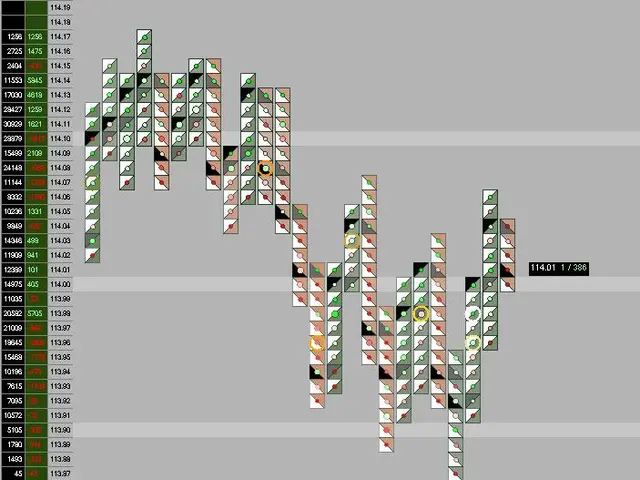

The Dow Jones Industrial Average (DJIA) closed at 48,063 points on Wednesday, slipping after briefly testing the 48,000 mark. The decline came as broader U.S. markets also weakened, with the S&P 500 and Nasdaq retreating in thin holiday trading. Trading will pause for New Year's Day before resuming on Friday, January 2, 2026.

The index, often referred to as the 'Dow', has lost momentum heading into the year-end, dragged down by rising Treasury yields and profit-taking in heavyweight stocks. Companies like IBM, American Express, Disney, and Boeing were among the worst performers. Despite the recent dip, the Dow remains up roughly 13% over the past twelve months and sits about 28% above its 52-week low.

Nike stood out as a bright spot, with shares surging after CEO Elliott Hill made a significant personal purchase. The 48,000-point level is now seen as a critical near-term support zone for the index. Meanwhile, the Relative Strength Index (RSI) for the Dow stands at 62, indicating neutral to slightly elevated territory. No positions from the Federal Open Market Committee (FOMC) Board were expressed in 2023 regarding potential interest rate cuts in the new year.

The Dow's recent weakness reflects broader market trends as investors adjust positions ahead of the new year. With trading set to resume on January 2, attention will turn to whether the index can hold above the 48,000 support level. The market's performance in early 2026 will depend on economic signals and investor sentiment.