Deutsche Telekom Shares Face Pressure Despite Buy Recommendations

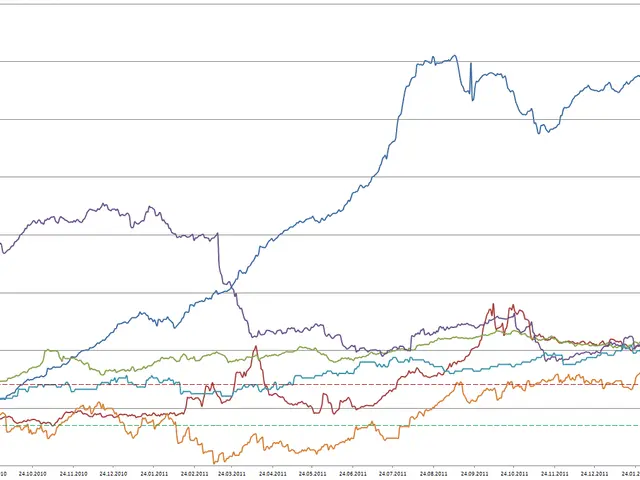

Deutsche Telekom's stock performance has been a mixed bag, with analysts offering contrasting views. While the stock is under pressure, with a significant gap from its 52-week high, several institutions have maintained a positive outlook.

In recent days, prominent financial institutions such as JP Morgan Chase & Co., UBS AG, Bernstein Research, DZ Bank, and ODDO BHF have issued buy recommendations for Deutsche Telekom shares. Notably, JP Morgan Chase & Co. has confirmed an 'Overweight' rating and a price target of approximately 43.50 EUR.

However, the '1234 short' signal has indicated potential selling pressure, with the closing price of 29.06 EUR well below its 50-day average. This discrepancy between technical and fundamental analysis has sparked debate among investors. Chartists have warned of a possible correction, while fundamentalists remain optimistic about the stock's prospects.

Despite the recent sell signal and the gap from the 52-week high, several leading institutions continue to back Deutsche Telekom. The conflict between technical and fundamental analysis highlights the uncertainty surrounding the stock's short-term performance. Investors will be closely watching to see which side prevails.