Construction activity in Toronto reportedly at its lowest since 2009, according to CMHC data

Toronto's Construction Activity Remains Sluggish, According to CMHC

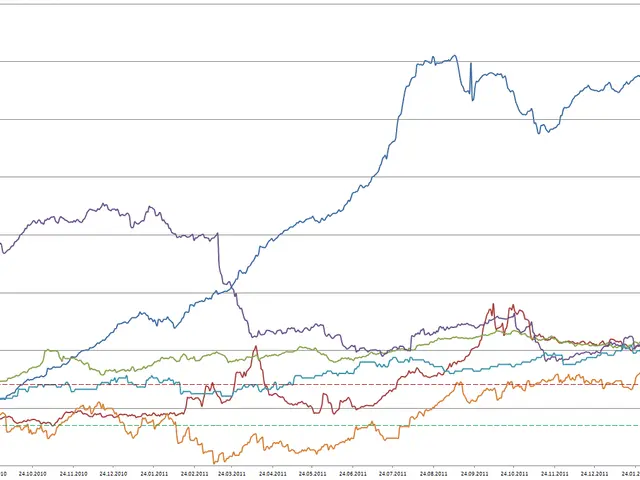

The Canadian Mortgage and Housing Corporation (CMHC) has predicted a marginal recovery in construction activity in Toronto for the years 2026 and 2027, with levels remaining well below historical norms. This stagnation could have far-reaching consequences for the city's overall economic health, potentially leading to increased outmigration, an uptick in homelessness, and lost tax revenue.

Toronto is on track for its lowest annual housing starts total in 30 years. The slowdown in construction has been particularly noticeable in condo development, with new builds dropping by a significant 60%. This trend is reflected in the city's housing market, where sales of new homes have plummeted in recent months, surpassing even the levels seen during the 1990s downturn.

Despite the slump in condo construction, rentals have managed to hold steady, thanks in part to optimism among developers in the long-term rental market. Rentals across the Greater Toronto Area (GTA) have been dropping, according to a combined report from Urbanation and Rentals.ca, with one-bedroom apartment rent in the GTA dropping by more than five per cent and two-bedrooms by three-and-a-half per cent over the last year.

The report also points to a stark divide between Toronto and other major Canadian cities like Calgary, Edmonton, Montréal, Ottawa, and Halifax, which are building homes at record or near-record pace.

The cause of Toronto's construction slowdown can be traced back to a pullback in investor demand during the first half of 2025, which has led to reduced project feasibility, resulting in cancellations, delays, and a sharp drop in construction. Economic uncertainty has also played a role, with potential condo buyers turning to the resale market, which offers a vast supply of lower-priced, larger, and potentially more suitable units.

Some condo developers have seen an opportunity in rentals, with nine projects having been converted to rental properties since 2024. Many in the building community suggest that construction costs and development charges must be reduced to ease condominium prices and improve project viability.

The CMHC's fall housing supply report, released recently, identified Toronto as having the slowest residential construction in the first half of the year. Despite the challenges, the report did not indicate that any organization reduced housing construction activities in Toronto during autumn 2025 or provide a reason for such action.

In the face of these challenges, Toronto's housing market continues to evolve, with the condo resale market reaching a record high in the second quarter of the year. As the city navigates these changes, it remains to be seen how the construction landscape will shift in the coming years.

Read also:

- Emergency vehicle arrives thirty minutes late while man transports father to hospital

- GAC Aion stepping up recruitment efforts in anticipation for global market expansion in China

- Top-Notch Books for Business Motivation: A Compulsory Reading List for Achieving Success

- Exploring Elon Musk's Wealth: Investigating the Billionaire's Monetary Domain