China Resources Land's mixed-use strategy offers resilience amid market turbulence

China Resources Land Ltd remains a key name in China's property sector, though its future continues to divide investors. The company's focus on mixed-use urban developments sets it apart from competitors, but risks persist in a volatile market. Debates over its stability and growth potential highlight both opportunities and concerns for those considering an investment.

The firm specialises in large-scale projects that combine residential, retail, and office spaces. This approach has helped it stand out in a crowded market, offering a buffer against some of the worst fluctuations. Yet, like many Chinese developers, it operates in an unpredictable political and economic environment.

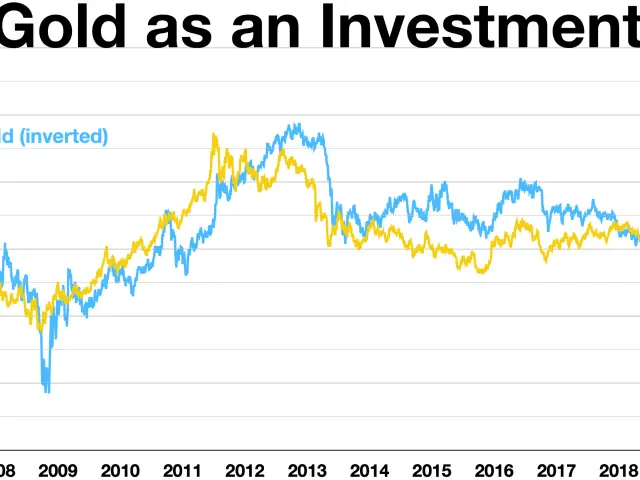

A comparison with China Vanke reveals shared challenges, from regulatory pressures to shifting demand. However, China Resources Land's emphasis on commercial and mixed-use properties gives it a distinct edge in certain areas. While its stock is viewed as steadier than some of its heavily indebted peers, the lack of recent performance data makes direct comparisons difficult.

For high-risk investors, the company's shares present a speculative bet. Short-term gains are possible, but so are steep losses. Meanwhile, long-term backers and newcomers are advised to tread carefully, with many suggesting a diversified portfolio to spread exposure beyond China's property sector.

China Resources Land Ltd offers a mix of promise and uncertainty. Its mixed-use strategy provides some resilience, yet broader economic and political shifts in China keep risks elevated. Investors weighing its potential must balance the chance of rewards against the threat of significant downturns.