Barclays lures German investors with strong earnings and shareholder rewards

Barclays has caught the attention of German investors as a potential buy. The British bank, one of Europe's largest, recently reported strong quarterly earnings that beat market expectations. Analysts now describe it as an undervalued stock with solid returns for shareholders.

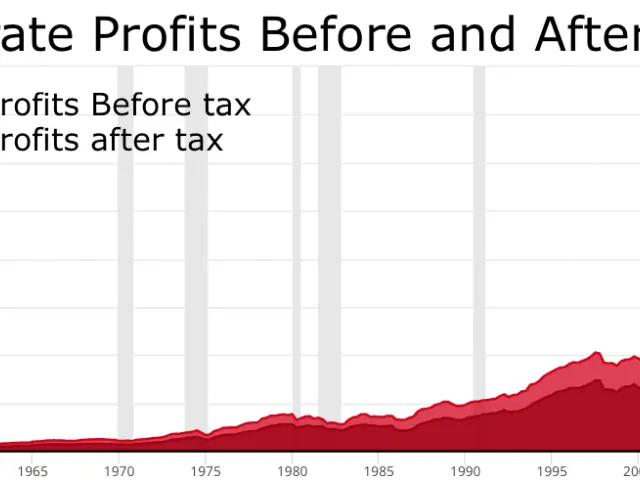

The bank's latest financial results stood out in a tough environment for lenders. Despite low interest rates and broader pressure on banking stocks, Barclays delivered better-than-expected profits. This performance has led to a higher dividend payout and the launch of a new share buyback scheme.

Shareholder returns have improved further, with both dividends and buybacks increasing. Analysts highlight the bank's international investment banking and credit card divisions as key areas for future growth. These segments could drive long-term value, even as other parts of the sector struggle.

Yet, risks remain. Barclays faces exposure to the UK economy, which could bring volatility. The cyclical nature of investment banking also means earnings may fluctuate with stock market today conditions.

German investors are now weighing whether to add Barclays to their portfolios. The bank's recent financial strength and shareholder-friendly moves make it a standout in a difficult stock market. However, potential buyers must consider the risks tied to its UK focus and the ups and downs of investment banking.