Bangladesh gold prices surge again amid global market volatility

Gold prices in Bangladesh climbed again on Monday after a brief dip the previous day. The latest increase follows a global surge in the value of pure gold over the past three months, driven by factors such as a weaker US dollar, geopolitical tensions, and high government debt. Local jewellers adjusted rates in response to these changes.

The Bangladesh Jewellers Association raised prices at 10:00am on Monday. Traditional gold now sells for Tk 174,900 per bhari, up by Tk 2,057 from Sunday's rate of Tk 172,843. Similarly, 22-carat gold reached Tk 261,040 per bhari, an increase of Tk 2,216, while 21-carat gold rose by Tk 2,221 to Tk 249,260. The price of 18-carat gold also went up by Tk 2,161, settling at Tk 213,656 per bhari. Silver prices, however, stayed unchanged at Tk 6,357 per bhari for 22-carat silver.

This year alone, local gold rates have been adjusted 28 times, with 18 increases and 10 decreases. The latest hike reflects broader global trends. Between November 2025 and early February 2026, international gold prices soared, hitting a record high of $5,594 per troy ounce on January 29. By February 8, prices had corrected by 14%, falling to around $4,967, though January still saw an 11% gain.

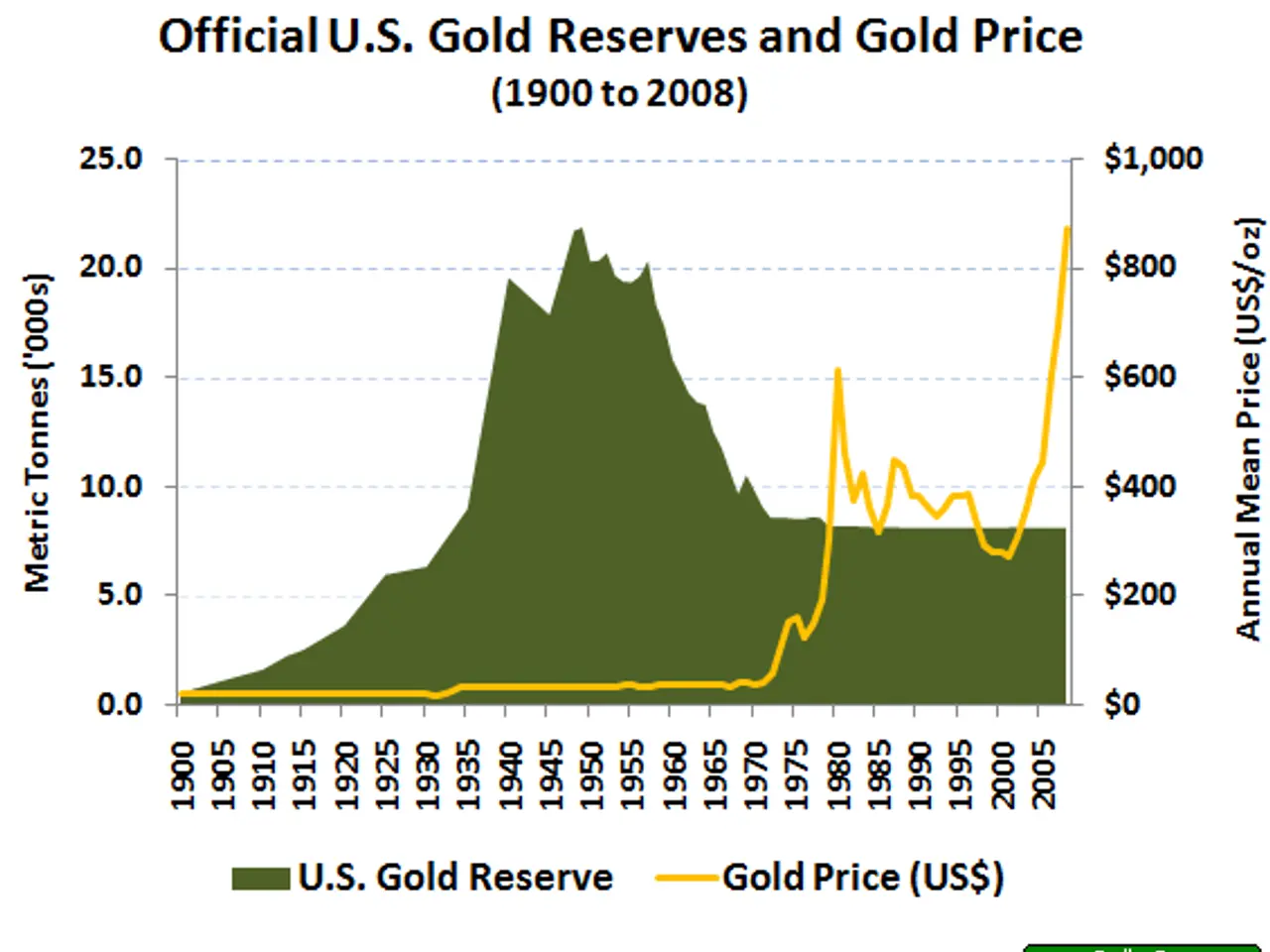

Several factors drove the volatility. A weaker US dollar, geopolitical tensions, and high government debt all played a role. Central banks also shifted reserves from the dollar to gold, while potential changes in Federal Reserve leadership under new chair Kevin Warsh added uncertainty. Margin increases on the COMEX exchange further accelerated the price correction.

Domestically, buyers must also account for a government-mandated 5% value-added tax and a minimum 6% making charge on gold jewellery.

The latest price adjustments bring gold rates in Bangladesh closer to global market movements. Consumers now face higher costs for all major gold categories, though silver remains stable. The frequent changes this year highlight ongoing volatility in both local and international markets.