Auckland property flipper ordered to pay $1M after failed resale

An Auckland property reseller has been ordered to pay over $1 million in damages to a couple left financially strained. Paljeet Singh failed to settle on their Avondale home after the market dropped, leaving them out of pocket. The case highlights risks in the fast-moving world of property flipping, where quick resales can turn into costly mistakes.

Singh had planned to sell the couple's home before the settlement date in 2022. But when the stock market today declined, he could not cover the costs, leaving the original owners with heavy losses. The High Court ruled he must pay $1 million in damages, plus $99,604.48 in contractual interest at 14% from November 23, 2022, to April 14, 2023.

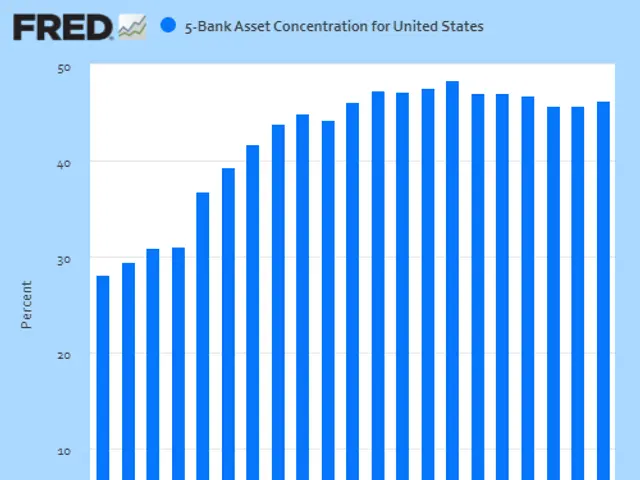

Property flipping has surged in 2024, reaching levels not seen since 2007, just before the global financial crisis. The practice is most common at the lower end of the market, where first-home buyers often compete. Experienced flippers focus on properties with quick resale potential, often buying at discounts and selling on for profit.

Industry insiders note that some investors remain unaware of current low prices, creating opportunities for flippers. Steve Goodey, a property investment coach, confirms the role of 'buyers' advocates'—professionals who source discounted properties and sell them to investors for a fee. The number of contemporaneous sales, where a property changes hands twice in quick succession, has also risen sharply this year.

The court's ruling against Singh serves as a warning to those involved in rapid property transactions. With flipping activity at its highest since 2007, buyers and sellers face greater risks in a volatile market. The case also underscores the need for caution when dealing with quick resales, particularly in areas popular with first-time buyers.