Apartments are now prepared for occupancy.

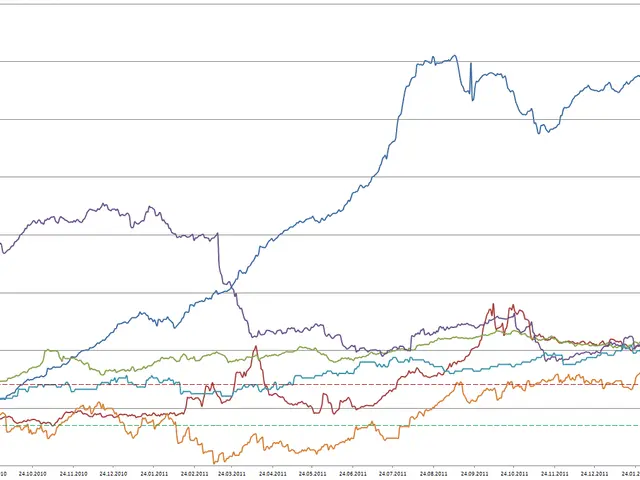

The rental market in Russia is experiencing a significant surge, with analysts predicting a growth of up to 82.5% by 2030. This growth is largely attributed to the rise in housing prices, making mortgages less affordable for many, thereby encouraging property owners to rent out their apartments instead.

In 2024, the rental market turnover reached an impressive 19.7% year-on-year increase, totalling 2.18 trillion rubles. By 2025, the total volume of housing available for market rental is forecast to be 282 million sq. m, an increase of 12.4% year-on-year.

The growth in rental market demand is also evident in the number of rental listings. According to Avito Real Estate, the number of rental listings increased by 30% year-over-year in July 2022.

The growth in the rental market, however, has not made it an appealing investment for many. Analysts consider the yields acceptable, but they note that they are lower than the potential gains from investing in OFZs and bank deposits.

Despite the lower yields, the rental market in major cities like Moscow and St. Petersburg still offers attractive returns. As of the end of 2024, the average yield in Moscow was 5.7%, in St. Petersburg - 6.1%, and in other cities - 6.2%, according to Expert RA data.

The rental market growth is reflected in the increase in apartment rents. In St. Petersburg, the average cost of a one-bedroom apartment increased by 12% year-over-year to 47,000 rubles per month. Moscow followed closely behind with a 6% year-over-year increase, reaching 63,500 rubles per month. Even in smaller cities like Samara, the average cost of one-bedroom apartments increased by 20% year-over-year in September 2022, reaching around 24,000 rubles per month.

By 2030, rental rates are projected to increase by 42.4% compared to 2024 levels, according to "Expert RA". The rental offering is also expected to reach 458 million sq. m, representing a 9.1% increase from 2029 and an 82.5% increase from 2025.

It's worth noting that the share of rental housing in Russia's total residential housing stock is expected to reach 7% in 2025 and potentially 10% by 2030. This is significantly lower than in many foreign countries, with Switzerland having 62%, Germany 55%, the UK 31%, Canada 30%, and Italy 20%.

The growth in the rental market is a positive sign for the real estate sector in Russia, offering opportunities for both renters and investors. However, the lower yields compared to other investment options remain a factor that limits the growth of the long-term rental market.