Annaly Capital boosts 2025 dividend as mortgage rates ease pressure

Annaly Capital has raised its dividend for 2025, signalling improved performance. The company, a mortgage real estate investment trust (REIT), has operated since its 1997 IPO with a focus on generating returns through dividends and mortgage-backed securities. While its total return has outpaced the broader market, its dividend history remains volatile.

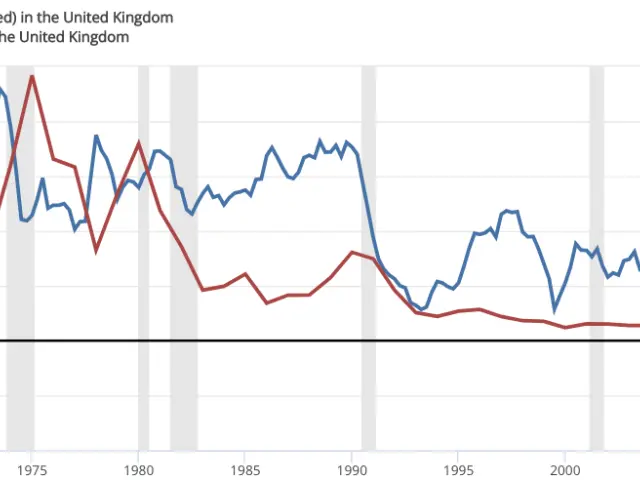

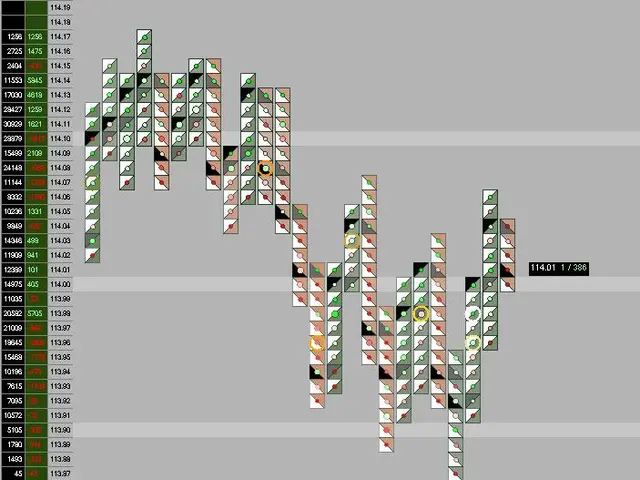

Annaly launched in 1997 with a clear goal: to deliver strong risk-adjusted returns by investing in mortgage-related assets. As a mortgage REIT, it earns income from net interest margins, pays substantial dividends, and adjusts its portfolio and hedging strategies to navigate changing mortgage rates. Over time, its dividend levels, book value, and share price have shifted with mortgage rates and credit cycles.

The latest dividend increase follows a reverse stock split and has held steady through the first three quarters of 2025. Earnings available for distribution have covered the new payout in each of these quarters. Lower mortgage rates have also helped by cutting borrowing costs, which boosts profitability.

Despite its long-term outperformance of the broader market, Annaly’s dividends have never been stable. The company’s strategy prioritises total return rather than predictable income, meaning shareholders often need to reinvest dividends to benefit fully. A stronger housing market could further support its business, given its reliance on mortgage-backed securities.

Annaly’s recent dividend increase reflects its current financial strength and favourable market conditions. However, its focus on total return rather than steady income means investors must still expect fluctuations. The company’s performance continues to diverge from broader market trends, offering potential diversification benefits.