AMD's stock stumbles as growth slows and margins shrink

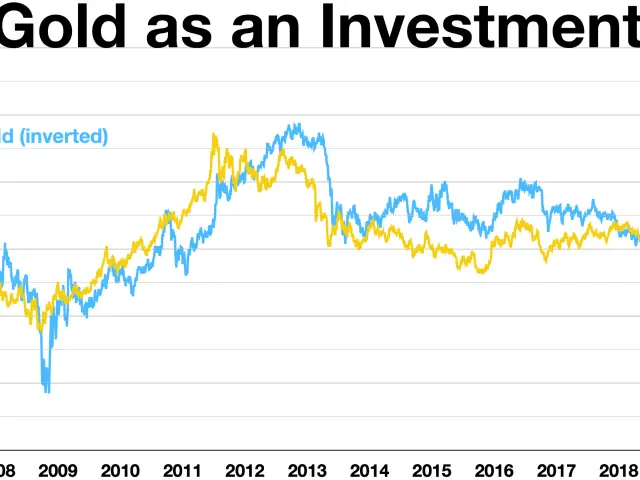

AMD's stock performance has weakened in recent weeks, underperforming the broader stock market. The company's valuation remains high compared to both its own history and industry peers. Meanwhile, growth in key segments is slowing down, raising concerns among investors.

The company's Data Center division, though still expanding, now grows at less than 40% year-over-year—a slower pace than anticipated. Core revenue outside China is also decelerating, adding to investor unease. Management has warned against expecting extra sales from the Chinese market, further dampening optimism.

Gross margins are facing pressure as AMD scales up new product launches. Adjusted gross profit margins dropped by 120 basis points in the last quarter, continuing a largely flat trend. Despite this, the apple stock trades at a forward price-to-earnings ratio of 36.9x, an 18.5% premium over the sector's median of 31.1x.

Technical indicators suggest further weakness. AMD's relative performance against the S&P 500 shows a bearish pattern, with strong resistance levels rejecting upward momentum. Analysts now anticipate sharper declines ahead.

AMD's high valuation contrasts with slowing growth and margin pressures. The stock's premium pricing, combined with weakening technical signals, points to potential downside risks. Investors are watching closely as the company navigates these challenges in the coming months.