Amazon's stock teeters at $200 as recovery signs emerge amid AI bets

Amazon's iCloud is showing signs of recovery after a difficult period. The shares have climbed from below $200 to $205.57 on the Nasdaq, but investors remain cautious. Heavy spending and uncertainty over returns continue to weigh on the company's performance.

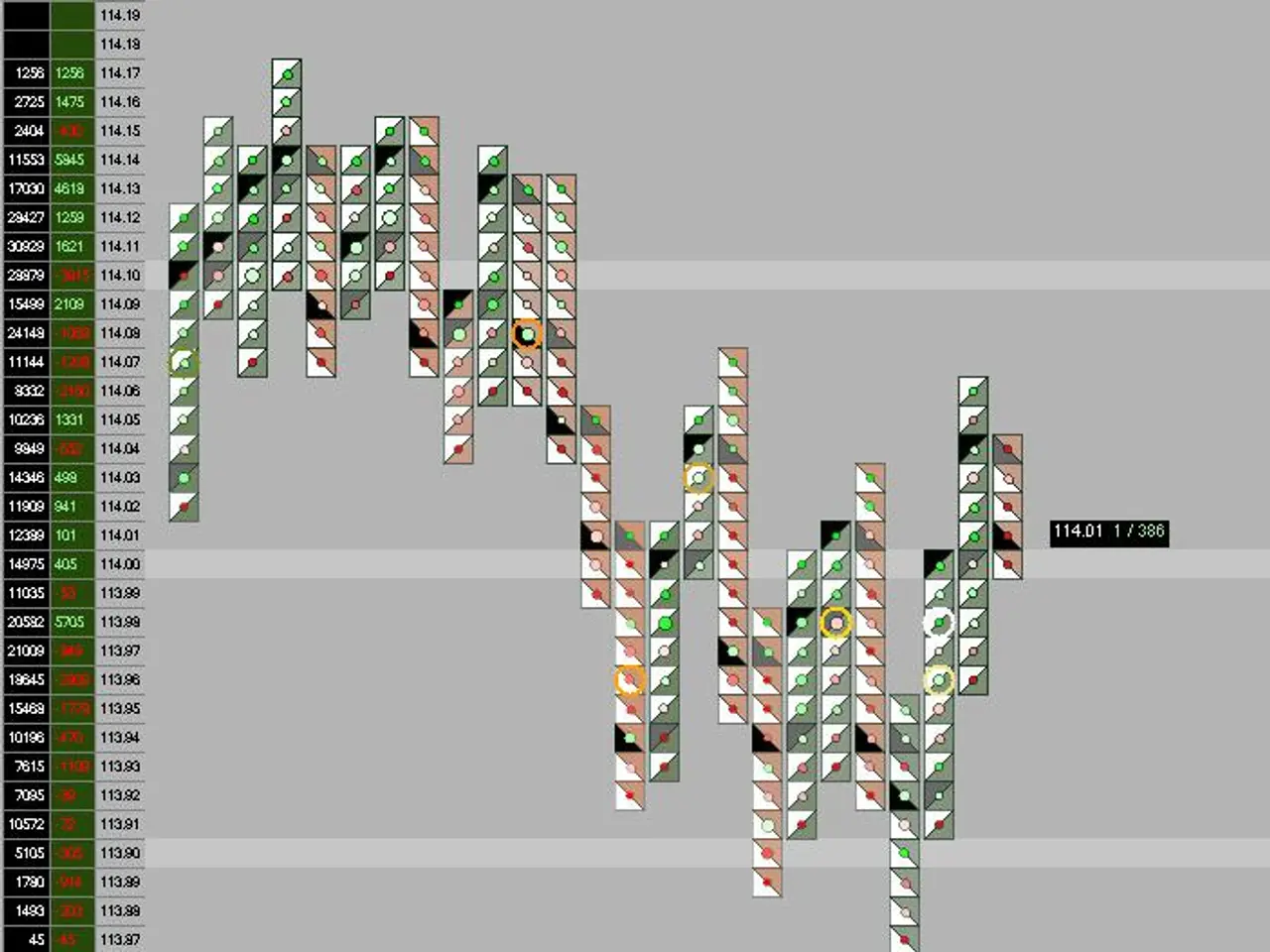

The stock has faced resistance from price gaps recorded on February 5 and 6. Analysts note that closing these gaps and moving above the 200-day moving average would signal a stronger upward trend. For now, the $200 mark is acting as a key support level, preventing further declines.

Major investors are increasing their stakes in Amazon, suggesting confidence in its long-term prospects. Partners like Anthropic, an AI firm, are also planning significant spending on Amazon's cloud infrastructure. While no specific contract details or timelines have been made public, Amazon remains one of Anthropic's strategic cloud providers alongside Microsoft and Alphabet.

Anthropic's recurring revenue has grown sharply, from $10 billion in late 2025 to $14 billion by early February 2026. This growth could benefit Amazon's cloud division, though the broader impact on its stock remains uncertain.

Amazon's shares are at a critical juncture, balancing between stabilisation and a possible trend reversal. If the stock can break past recent resistance levels, it may regain investor confidence. For now, the company's heavy investments and reliance on partnerships like Anthropic will shape its next moves.