Alkane Resources Soars Post-Merger, Forecasts Double Gold Production by 2026

Alkane Resources, following a successful merger with Mandalay Resources, has emerged as a significant player in the gold mining sector. The company now operates three producing mines in Australia and Sweden, yielding 70,120 ounces of gold in the last fiscal year. This achievement was accompanied by $33 million in after-tax profits and the elimination of all debt.

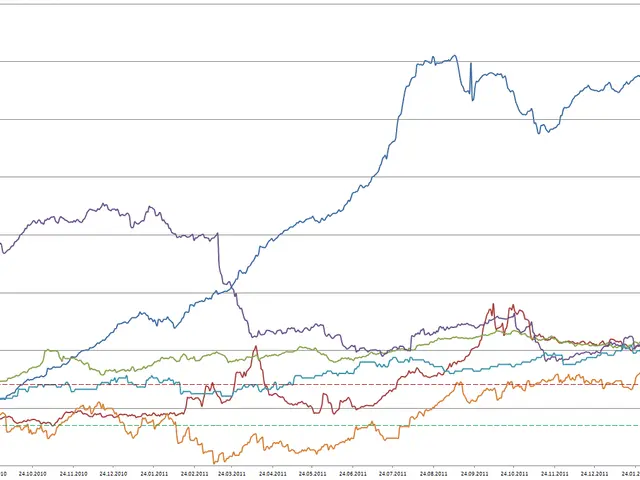

The company's growth and potential have not gone unnoticed. In September, Alkane Resources was included in the prestigious S&P/ASX 300 Index, a move that typically signals increased institutional attention and greater liquidity for investors.

Looking ahead, Alkane Resources forecasts a substantial increase in gold production. By 2026, the company expects to produce between 160,000 and 175,000 ounces of gold, more than double its previous production. This optimistic outlook is supported by gold prices remaining above $3,760 per ounce.

Meanwhile, Ian J. Gandel, a non-executive director at Alkane Resources, recently sold 24 million shares on October 1, 2025. This transaction, worth over AU$26.6 million, reduced his stake by more than a fifth.

The company's stock performance has been impressive. Over the past 12 months, Alkane Resources' shares have surged by 142%. Currently, they are trading only slightly below their 52-week high, with a Relative Strength Index (RSI) of 38.8, which does not suggest overheating or overvaluation.

Alkane Resources, post-merger, has demonstrated strong financial performance and growth potential. With three producing mines, increased institutional attention, and a promising outlook for gold production, the company is well-positioned in the gold mining sector. Despite recent share sales by a non-executive director, the company's stock has shown remarkable strength and continues to trade near its peak.