AI panic wipes $611 billion from global markets in one week

A wave of uncertainty around artificial intelligence has sent shockwaves through global markets. Over the past week, 164 companies across software, finance, and asset management lost a combined $611 billion in value. The sell-off began after Anthropic unveiled new AI-powered automation tools, raising fears about long-term business survival.

The sharpest drop came from Thomson Reuters Corp., whose shares plunged 20%—its worst weekly loss ever. On January 30, 2026, the company's stock fell 18% in a single day after Anthropic launched a legal AI plugin. Over 30 days, the decline reached 33.22%, with a 67.02% drop from its 52-week high of €186.25. By early February, its market value stood between €52.64 billion and €68.05 billion, far below the US Tech 100 index's performance.

Other major firms also suffered. Expedia Group Inc., Salesforce Inc., and the London Stock Exchange Group Plc. saw steep losses. Software companies like HubSpot Inc., Atlassian Corp., and Zscaler Inc. experienced declines of over 16%. The turmoil follows years of debate sparked by OpenAI's 2022 release of ChatGPT, which first highlighted AI's disruptive potential.

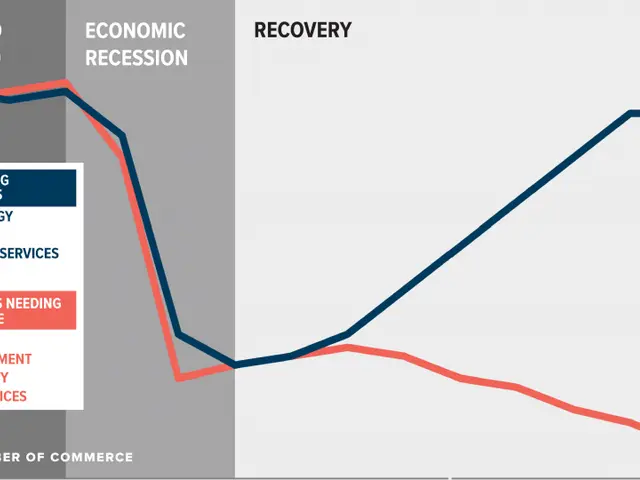

Experts remain divided on which businesses will adapt and thrive. Some may need to completely reinvent their models to stay competitive. Others could face existential risks if AI automation renders their services obsolete.

The market reaction reflects deep uncertainty about AI's economic impact. While some companies may recover or pivot, others could struggle to survive in an increasingly automated landscape. For now, the long-term winners—and losers—remain unclear.