Accomplishments, hurdles, and the luxury abode worth $100,000 he calls home.

In the tumultuous year of 1970, as Quebec nationalism reached a boiling point and the October Crisis unfolded, many affluent English-speaking families found themselves reconsidering their roots. Among them was Stephen Jarislowsky, a prominent investor who made a decision that would shape his life and career for decades to come.

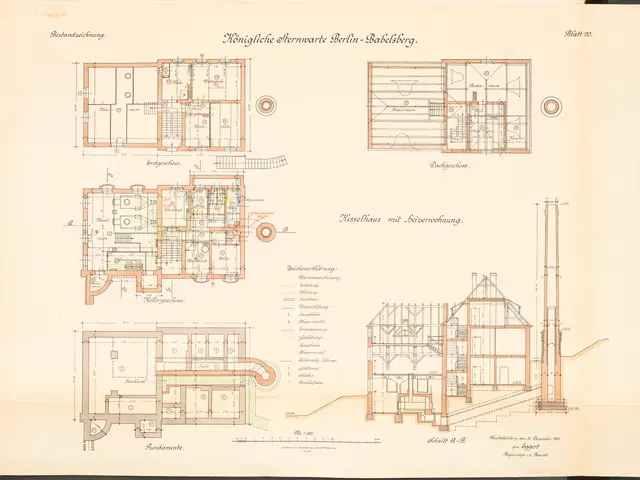

Rather than joining the exodus to Toronto, Jarislowsky chose to stay in Quebec, purchasing a house in Westmount for $100,000 in 1972. Today, that house is worth more than its original purchase price, a testament to both the city's growth and Jarislowsky's shrewd investments.

Jarislowsky's connection to Quebec runs deep. He served on the board of Montreal engineering firm SNC Lavalin for 20 years, an investment he has maintained for several decades. Currently, his shares in the company are valued at $93 each. Despite the SNC Lavalin scandal that rocked the nation, Jarislowsky remained steadfast, choosing not to sell his shares.

His success with SNC Lavalin, he attributes to patience and a good management team. Jarislowsky's average purchase price for SNC Lavalin shares is $1, making his current investment a significant return on his initial investment.

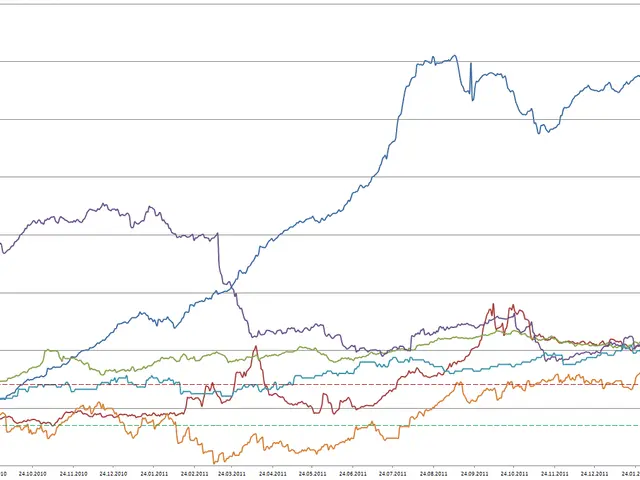

Jarislowsky's relationship with SNC Lavalin isn't the only long-standing one in Quebec. In 2018, his discretionary asset management firm, Jarislowsky Fraser, was sold to Bank of Nova Scotia. During the sale, Jarislowsky was paid in shares, a move that has proven to be less fruitful, as Royal Bank shares have performed better than Bank of Nova Scotia shares in recent years.

Despite this, Jarislowsky remains committed to Quebec. He feels comfortable living in the province, boasting many French-speaking friends. French-speaking people reportedly hold a fondness for Jarislowsky, more so than his English-speaking counterparts.

The house in Westmount, located near a park, is still owned by Jarislowsky and his wife. In recent years, Jarislowsky has increased his stake in ScotiaBank, acquiring more shares to strengthen his investment position rather than selling.

Through thick and thin, Stephen Jarislowsky's connection to Quebec remains unwavering, a testament to his faith in the province and its potential.