2025’s ‘Hated Rally’ Defies Investor Pessimism as Markets Surge Ahead

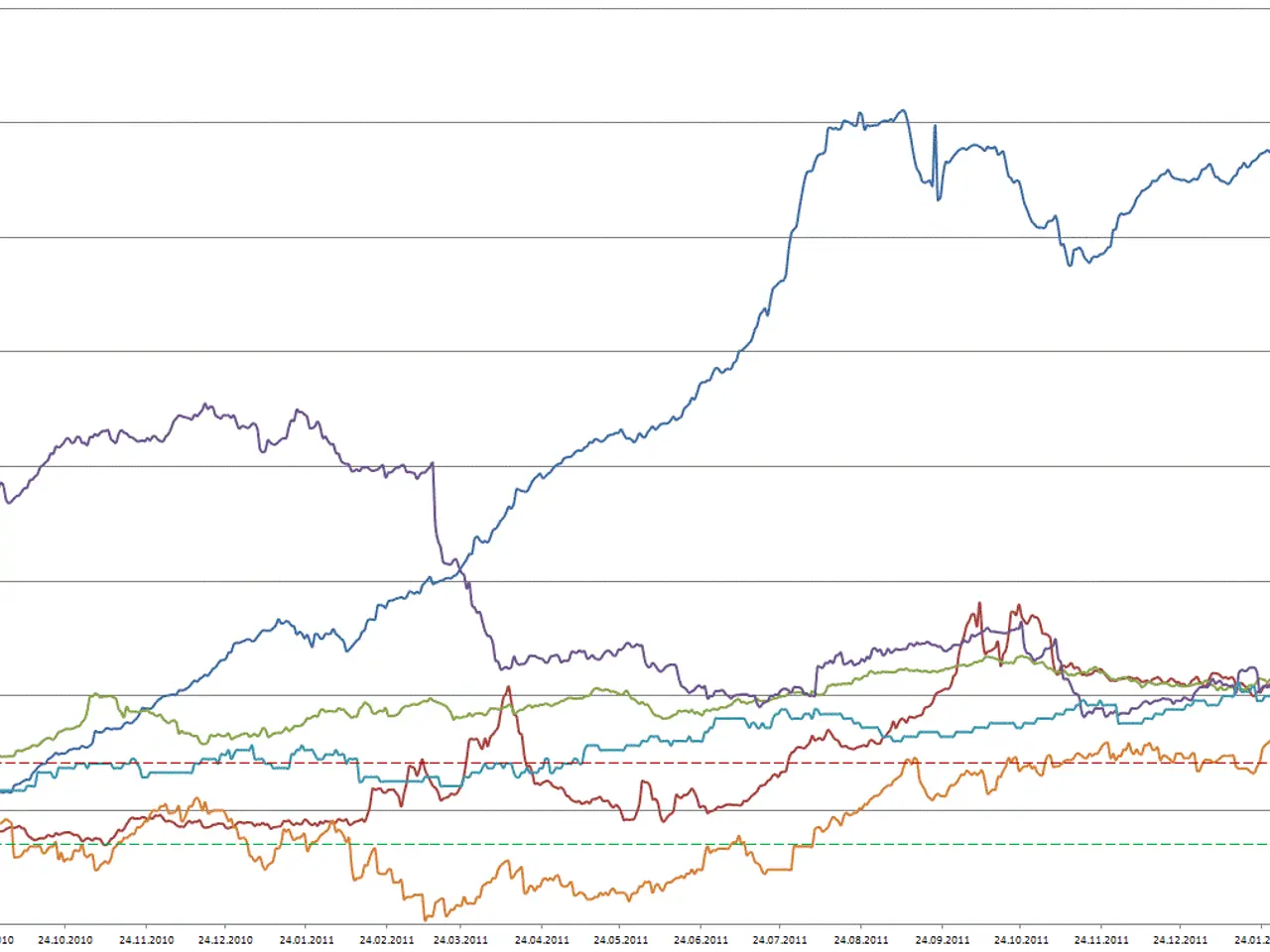

The stock market in 2025 has delivered stronger-than-expected returns, with major indices like the DAX, Euro Stoxx 50, and S&P 500 posting significant gains. Yet despite this performance, many investors remain wary, creating what analysts call a 'hated rally'—where pessimism lingers even as markets climb.

Markets have repeatedly defied gloomy forecasts in recent years. After the U.S. tariff announcements in early 2025, stocks rebounded sharply, mirroring the recovery seen post-Brexit in 2016. But experts warn against assuming every crisis will lead to a quick bounce-back, given the unique pressures of the current decade: geopolitical tensions, rapid technological change, and lingering economic uncertainty.

Central banks played a key role in stabilising markets toward the end of 2025. The European Central Bank (ECB) held its deposit rate steady at 2.00% on 18 December, reversing earlier declines in short-term savings rates. The Bank of England cut its benchmark by 0.25% to 3.75%, while the U.S. Federal Reserve followed with a similar reduction on 10 December. Sweden’s Riksbank kept its rate at 1.75%. These moves helped steady markets and support savers, even as inflation hovered near 2%. The persistent gap between market gains and investor sentiment has been dubbed the 'wall of fear'. Negative headlines and anxiety have dominated discussions, even as indices rise. Analysts attribute this to lingering doubts about long-term stability, given factors like AI advancements and shifting monetary policies. Looking ahead, broad diversification across regions and asset classes remains a recommended strategy. This approach aims to balance risks while still capturing growth opportunities in an unpredictable environment.

Investors are now preparing for increased volatility in 2026, with markets likely to react sharply to political decisions and economic shifts. While past rebounds have shown resilience, the interplay of central bank policies, technological disruption, and global tensions will continue shaping future performance.